Managing payroll itself is a daunting and complicated task, and paystub generation is one of the important sub-operations of payroll management. Generating or acquiring pay stubs for employees or yourself is essential if you want to show proof of income.

Whether you are a sole proprietor, small business owner, self-employed person, independent contractor, or entrepreneur, creating an accurate and professional paystub is like braving a storm without an umbrella.

There is no universal format for the pay stub, as one company’s pay stub might look very different from another’s pay stub. Perhaps you can make your own paystub, but you need to follow the structure to ensure clarity and accuracy. Let’s understand more about paystub generation in this blog.

What Is a Paystub?

A paystub is a document given by an employer to employees that breaks down:

- An employee’s earnings,

- Deductions,

- Net take-home pay.

A pay stub serves as a report of what amount an employee earned within a given pay period and indicates the different deductions taken from his or her gross pay, including taxes, insurance, or retirement.

An understandable and correct paystub not only assists workers in comprehending what they earn but also promotes transparency, enhances trust, and aids in keeping records for tax or borrowing-related purposes.

A well-designed paystub allows employees to quickly verify their earnings, deductions, and net pay, reducing confusion and ensuring transparency in the payroll process.

Who Requires Pay Stubs?

In recent years, electronic paystubs have become increasingly common. Digital versions are not only more convenient to store and access but are also eco-friendly and cost-effective for businesses. Regardless of whether a paystub is printed or digital, the key is that it should present all the necessary information in a clear and organized manner.

Paystubs Requirement Is For:

These are the people who require a paystub; the list is given below.

-

Employees

Paystubs are often demanded by institutions like banks or landlords as evidence of income during loan, mortgage, or rental applications. Employees need a pay stub to keep a record of their salary as well as to get a new job with the salary proof. Paystubs contain information regarding the employee’s earnings, taxes, and other deductions, so they are helpful for personal budgeting and tax return purposes.

-

Employers

Paystubs are created by employers to give employees transparency and to adhere to state regulations in some areas.

Paystubs also serve as a valuable bookkeeping tool, enabling employers to compare overall payroll costs to documented wage and labor expenses. Accurate and professional paystub maintenance ensures accurate company records and can shield the company from legal challenges in the event of disagreements.

-

Independent Contractors and Subcontractors

Independent contractors are not employees; therefore, taxes are not taken out of their pay. They get 1099 forms at the end of the year to confirm income from clients. Paystubs can assist contractors in ensuring the income shown on their 1099 is the same as the actual payments made. If there are discrepancies, the contractor is able to correct them with the client before filing taxes.

-

Self-Employed Individuals

Even self-employed individuals appreciate having paystub records. Single-member LLC owners, for instance, need to monitor payments from their business into their personal accounts in order to distinguish business and personal spending. Paystubs assist with reporting correct business profits on tax reports and are frequently needed by banks or other organizations for verification.

Paystubs are widely applied to multiple people, such as:

- All sizes of corporations

- Gig workers

- Tradesmen like plumbers, carpenters, landscapers, and tree maintenance firms

- Freelancers

Keeping accurate pay stubs keeps things transparent, makes accounting easier, and helps employers and employees manage both income and outgo.

Included Information On a Pay Stub

Pay stubs are vital documents that showcase an employee’s earnings and how deductions affect their take-home pay. A pay stub clearly demonstrates total income, deductions, and the final amount received as income or pay.

Knowing how a pay stub works helps employees keep an eye on their finances, verify the accuracy of pay stubs, and prepare for taxes or savings accounts.

-

Employee Information

The top section of a pay receipt contains personal and employment information as a form of validation to ensure the receipt is accurate and to the right employee.

Key information will normally include the following:

- Name: the employee’s full name.

- Employee Number: a unique identifier assigned by the employer.

- Pay Period: the start and end dates for the pay cycle.

-

Other Deductions

In addition to taxes, there may be other deductions from gross pay to determine the final net pay.

Some examples of common deductions include:

- Retirement contributions.

- Health insurance premiums.

- Repayment on loan amounts.

- Charitable donations.

It is common for each deduction to appear specifically identified, along with the year-to-date amount, so that the amounts can be tracked consistently.

-

Gross Pay

Gross pay refers to the total earnings before any deductions are taken out for tax or social insurance purposes. It may include:

- Salary: The guaranteed salary that covers normal expectations of work.

- Overtime pay: Payment made for hours worked outside of the normal work schedule.

- Bonus: An incentive or reward provided as additional salary.

- Commission: Pay based on sales or attaining other performance goals.

-

Taxes

Taxes are required deductions from gross pay, including:

- Federal Income Tax: These payments must be made to the federal government.

- State Income Tax: Payable to the state government.

- Local Taxes: Payable to the city or local government.

- Social Security Tax: Funds Social Security programs.

- Medicare Tax: Payments made towards senior healthcare services.

-

Net Pay

Net pay or take-home pay refers to the total wages an employee actually receives after all deductions have been taken out.

Employee net pay typically comprises:

- Pay Period Net Pay: Wages paid during each pay period.

- Year-to-Date Net Pay: * Total Year-to-Date Pay when taking into account pay periods that occur throughout the year

Pay stubs provide complete transparency, employee verification of earnings, and expense planning—vital components in personal financial management—as well as verify how pay is calculated.

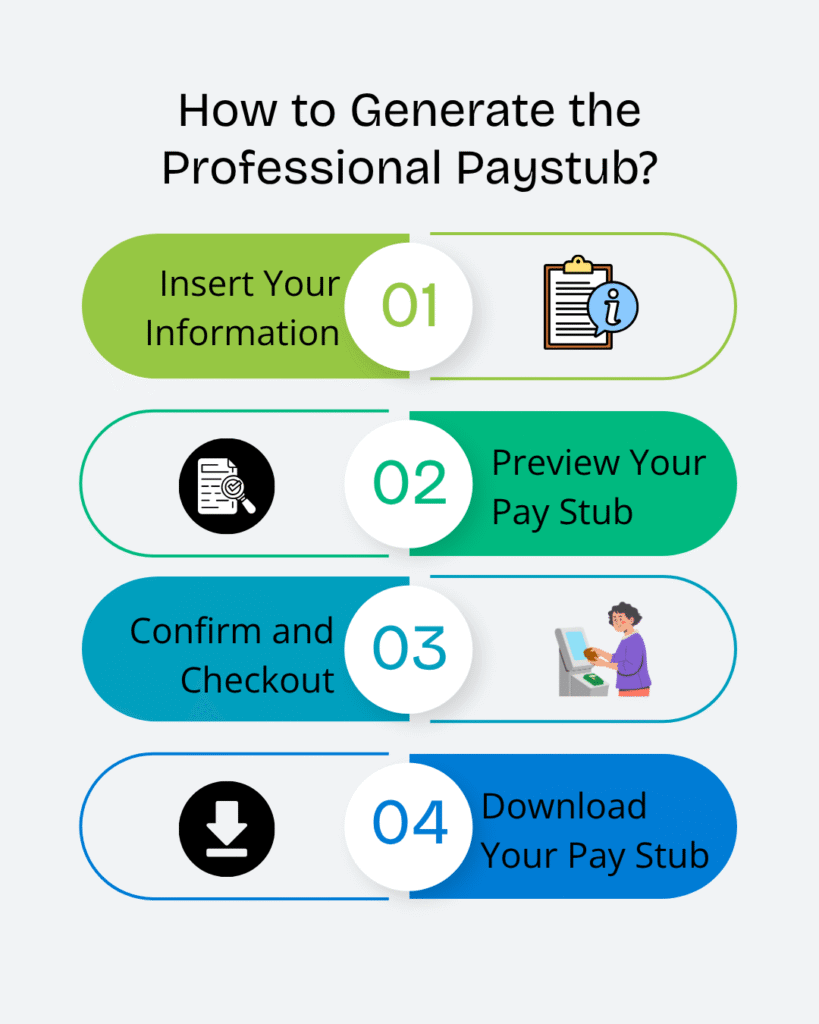

How to Generate a Professional Paystub?

Check the steps below to generate a paystub by using the paystub generator.

Step 1: Insert Your Information

Start by providing all necessary details, such as

- Your Company Name,

- Employee Information and Salary details,

- Payment Period.

After entering all required fields, our paystub generator will calculate taxes, deductions, and net pay automatically. Furthermore, there are multiple professional payroll stub templates to fit any business style or aesthetic.

Step 2: Preview Your Pay Stub

After entering your information, your paystub will provide a real-time preview that allows you to review all details regarding earnings and deductions before finalizing it.

Once satisfied with the preview, proceed to confirm your details and complete checkout. Our free paystub generator ensures a quick and straightforward process so you can generate professional paystubs in just minutes!

Step 3: Confirm and Checkout

Once satisfied with your preview, proceed to confirm your details and checkout using our free paystub generator; it provides an effortless process that generates professional paystubs in minutes!

Our free paystub generator ensures an effortless process, helping you generate professional paystubs in minutes.

Step 4: Download Your Pay Stub

After completing your checkout, a download button will appear.

Click the button, and your finalized paystub will be instantly downloaded to your device. It’s that quick and convenient; your accurate and ready-to-use paystub is just a click away.

Conclusion

Paystubs are more than a wage summary; they are formal financial reports that can impact significant issues like loan approval, rental payments, and other income verifications.

For employers, accurate issuance of paystubs is a legal obligation, whereas for employees, they are used to validate their earnings. Each paystub must include all necessary data to avoid errors, disputes, or delays in finances.

Whether you require generating new paystubs or having to examine existing paystubs, utilizing the appropriate tools and assistance guarantees your documentation is complete, accurate, and available whenever you require it. Utilizing a Stub Creator, you can create the paystub with very easy steps.

FAQ's

What information should a professional paystub include?

+

Employer and employee details, pay period, gross pay, itemized deductions (taxes, benefits), net pay, year-to-date totals, and employer tax IDs.

How do I ensure the paystub calculations are accurate?

+

Use reliable calculators or payroll software that apply current federal/state tax rates, round correctly, and include overtime, bonuses, and pre/post-tax deductions.

Can I customize paystubs for contractors or freelancers?

+

Yes — include hourly/rate info, contract period, invoice/reference numbers, and mark payment type (1099/contractor) while omitting employee tax withholdings.

Is it legal to use a free paystub generator for my business?

+

Generally yes, but ensure the generator produces accurate, non-misleading information, complies with local reporting requirements, and you retain records for tax and audit purposes.