Employers in the USA should understand both W2 and W4 forms to avoid incurring penalties from the Internal Revenue Service (IRS). Both forms must be filled out correctly at tax season’s end; however, many are confused as to the difference between these documents. It’s crucial for both employers and employees alike that both documents understand how they differ.

The deciding factors of W2 vs W4 are awareness, accuracy, and proper use of both documents, all of which help maintain financial stability as well as comply with the tax law.

This article presents the reasons why W-4 and W-2 forms are important. W-2 and W-4 forms are both essential for tax reporting and payroll processing. While they are related, each is designed for its own distinct use by the different entities.

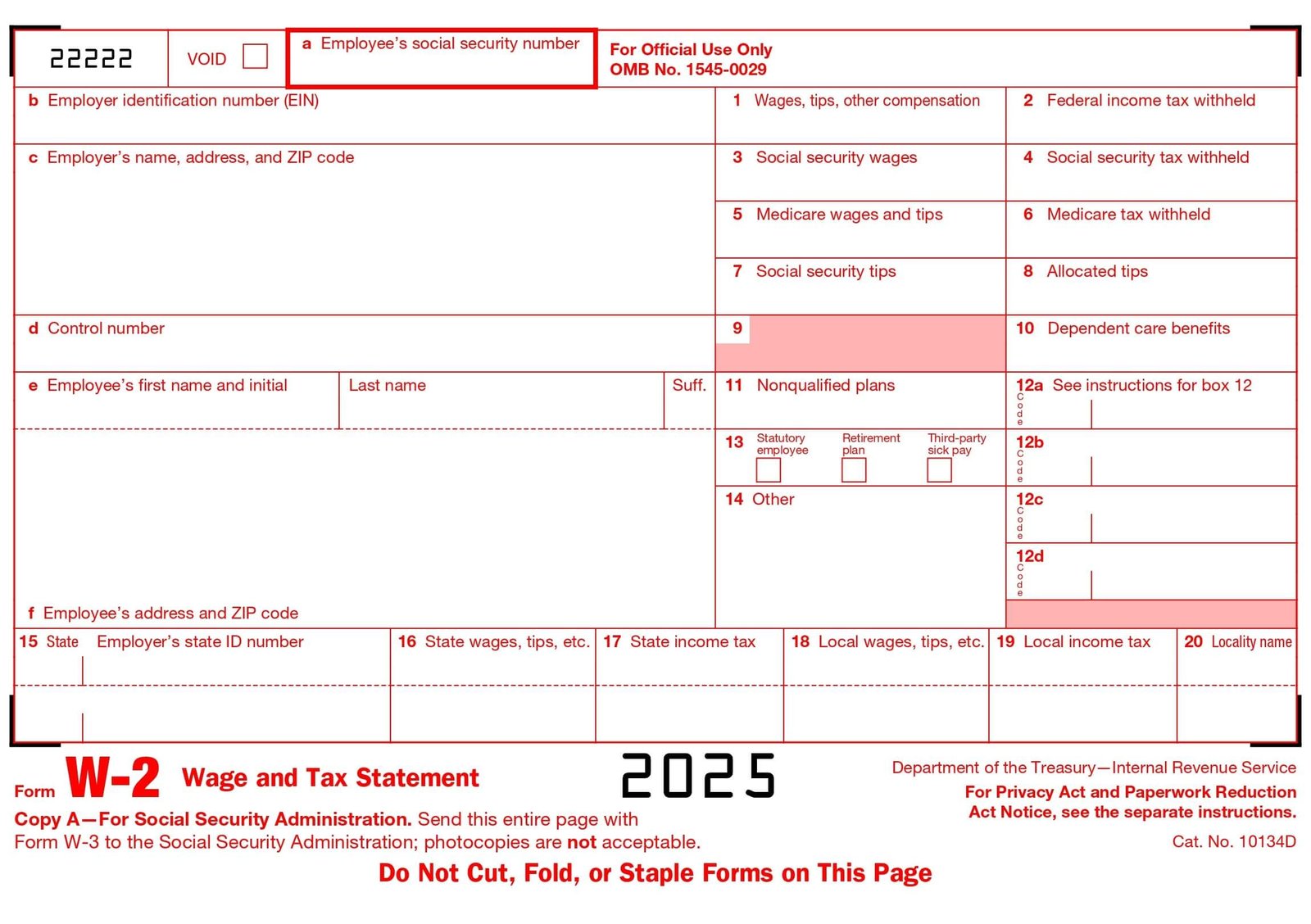

What Is Form W-2? And What’s Its Purpose?

Employers must file and distribute an IRS Form W-2, also known as a Wage and Tax Statement, to any employee earning $600 or more during any tax year, along with providing copies to the Social Security Administration (SSA). Employers are legally obliged to prepare, file, and distribute these W-2 forms even after employees no longer hold employment with their company.

The W-2 form provides the employee’s total earnings (including wages, tips, and other compensation), along with the amounts withheld for federal, state, and local taxes, Medicare, and Social Security, if applicable.

Significant Details Contained in the W2 Form

Every W-2 form includes specific areas such as:

- Employer Information: Name, address, and Employer Identification Number (EIN).

- Employee Information: Name, address, and Social Security number.

- Federal Income Tax Withheld: Amount withheld from the employee’s pay.

- Earnings and Compensation: Total wages, tips, and other income.

- State and Local Taxes: If applicable, taxes withheld for state or city purposes.

- Social Security and Medicare Tax Withheld: Total amounts withheld for contributions.

It is required to prepare a total of six official W-2 forms for different recipients.

- Copy A: Submit to the Social Security Administration (SSA).

- Copy B: For the employee’s federal tax return.

- Copy C: For the employee’s personal information.

- Copy D: For the employer’s records.

- Copy 1: State, city, or local taxing authority.

- Copy 2: To be filed by the employee with state, city, or local tax returns.

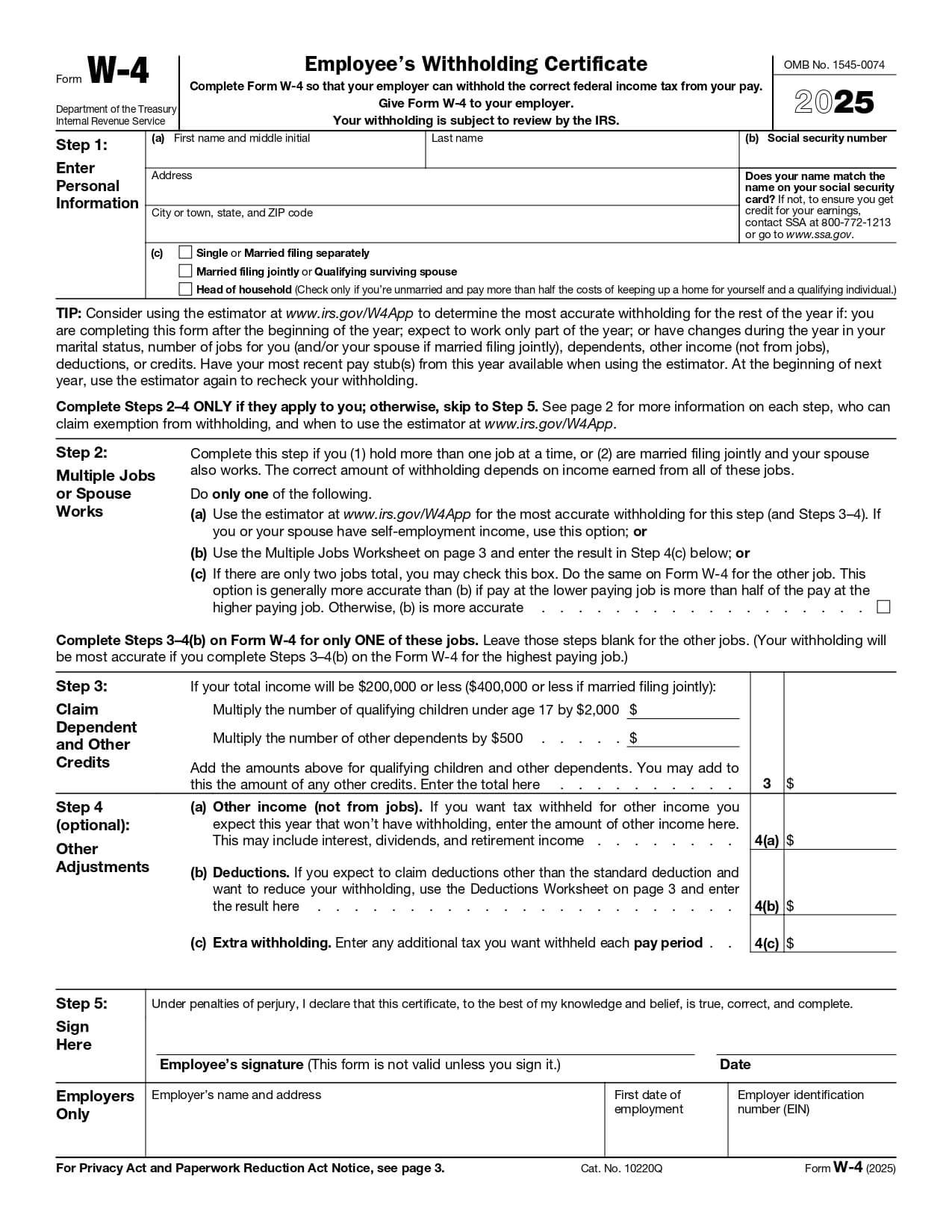

What Is Form W-4? And What’s Its Purpose?

The IRS Form W-4, also called the Employee’s Withholding Certificate, is used by employees when they start a new job or new tax situations or filing statuses occur. Employees will use the W-4 form to report information such as their filing status (single, married, head of household), whether they are employed in other jobs or their spouse is working, and the number of qualifying dependents.

The W4 form is provided to employers to state what amount of federal income tax to withhold from each paycheck. In certain states, there might also be a W-4 to submit to allow for the correct state income taxes to be withheld.

The IRS changed the W-4 form in 2020 in response to the Tax Cuts and Jobs Act (TCJA). One notable change was the elimination of personal exemptions, along with a higher standard deduction and an expansion of the Child Tax Credit.

Fundamental Details for W-4

Currently, the W-4 Form contains the following categories:

- Personal information: The employee’s name, address, social security number, and filing status

- Dependents: The number of dependents being claimed, and whether or not any tax credits can be claimed

- Employee has multiple jobs or a working spouse: Worker(s) information about the employee’s second job or spouse.

- Any other adjustments: Additional income, deductions, or additional tax withholding amounts.

W2 and W4 Forms Roles in Tax Withholding and Reporting

Tax withholding and reporting are fundamental measures that ensure both employees and employers accurately and timely pay their taxes. The government, through the IRS, requires that specific forms be used for this purpose, and among those are the W-2 and W-4 forms.

The W-2 Form

Employers use the W-2 form, also known as the Wage and Tax Statement, to report each employee’s total annual earnings along with the amount of taxes withheld throughout the year. This includes federal and state income taxes, Social Security, and Medicare contributions.

Employees receive a copy of their W-2 form at the end of the year, which they use to file their individual income tax returns. The information on the W-2 ensures that employees report their income accurately and know whether they owe more taxes or are eligible for a refund.

Format:

| Employee Details | Wages & Withholding |

|---|---|

| Employer’s Name, Address, and Identification Number | Federal Income Tax Withheld |

| Employee’s Name and SSN | Total Wages and Tips |

| Box 12 Codes, Box 13, and Box 14 | State and Local Income Tax Withheld |

The W-4 Form

The W-4 form, or Employee’s Withholding Certificate, is completed by employees and submitted to their employer. This gives the employer all of the details needed to determine how much federal income tax to withhold from each paycheck.

The W4 form includes information such as filing status, number of dependents, and any additional withholdings requested. It is recommended that all employees review and update their W-4 when any life change events occur, such as marriage, birth of a child, or a change in income, to ensure the proper amount of tax is withheld throughout the year.

W-4 vs. W-2: What Are The Differences

The major difference between W2 and W4 forms is the purpose and who uses them.

- Employers prepare and issue W-2 forms each year to report an employee’s total earnings and amount withheld during the year,

- Employees complete W-4 forms to inform employers how much federal income tax should be withheld from each paycheck.

The W2 vs W4 form comparison is important for employers and employees alike. The differences in each form determine how taxes are calculated, reported, withheld, and withheld from payroll processes, as well as individual financial planning strategies. Its timing and purpose play an essential part in complying with tax regulations.

W2 vs W4 comparison can be simplified as follows. A W-2 reports an employee’s annual compensation: wages, bonuses, and withholding tax withheld for Social Security and Medicare taxes. Conversely, the W-4 provides employers with key personal data like filing status, dependents, and withholding preferences.

| Feature | Form W-2 (Wage and Tax Statement) | Form W-4 (Employee’s Withholding Certificate) |

|---|---|---|

| Who Acquires it? | The employer | The employee |

| What is it for? | Reports total annual income from the employer and the amount withheld in federal income taxes | Informs the employer amount of federal income tax to be withheld from each paycheck |

| What is the filing process? | The employer gives a copy to the employee and files copies with the IRS and the state agency | The employee submits the completed form to the employer’s HR or payroll department |

| When do you use it? | Issued by the employer, generally by January 31 of the following year, sent either by mail or electronically | Filled out when starting a new job, or whenever a filing status and dependents change occur |

| Impact on Paycheck | Does not directly affect paycheck amounts | Specifies the amount withheld in taxes from each paycheck throughout the year |

| Use in tax return? | Yes – it is a document used to file an annual tax return, one of the key documents | No – it is kept on file by the employer and not filed with the IRS |

How Stub Creator Helps W-2 and W-4 Form Management?

Stub Creator makes payroll and tax documentation effortless by automating paystub creation using its comprehensive library of free pay stub template with calculator.

Small businesses and individuals alike rely on this free paystub generator due to its easy and straightforward platform – no lengthy contracts or complex setup requirements are necessary!

Stub Creator integrates seamlessly with tax preparation tools for seamless data transfer when filling and filing tax forms such as W-2 and W-4 forms. Create your paystub now while staying compliant with US laws!

Frequently Asked Questions:

1) What is better, W-2 or W4?

The W-2 and W-4 forms serve two distinct purposes. Employers complete the W-2 to report an employee’s annual wages and taxes withheld, while employees use the W-4 form to calculate how much tax should be withheld from their paychecks.

2) Do you need a W-2 or W4 to file taxes?

Your W-2 tax form is necessary in order to file your taxes; your employer only uses it during the year as they calculate tax withholdings.

3) How does W4 affect my paycheck?

The W4 form plays an essential role in your paycheck by determining how much federal income tax will be withheld from it. Allowances or dependents with greater allowances typically lead to less tax withheld, increasing take-home pay. Inversely, fewer allowances mean more tax withheld and smaller paychecks, but possibly larger refunds.

4) Does W-2 mean I have to pay taxes?

Your employer has withheld taxes from your pay and given you a W-2 form as evidence. However, depending on the total income and deductions for which taxes were withheld from each paycheck, additional amounts may still be owed or you could even receive a refund, depending on how your situation unfolds.

5) Can I refuse to fill out a W4?

Your employer must withhold taxes at the highest rate (single without dependents) if you fail to complete a W-4 form.

6) What happens if I don’t fill out a W4?

If you fail to submit a W-4 form, your employer may withhold taxes as though you were single without dependents – often leading to more taxes being withheld from each paycheck.

7) What is the difference between w2 and w4 forms?

Employers issue W-2 forms to report wages and taxes withheld, while employees complete W-4 forms in order to inform employers how much tax to withhold from each paycheck.

8) When should I update my W-4 form?

Update your W-4 whenever major life changes occur – such as marriage, divorce, giving birth, or experiencing changes in income – and at least once annually thereafter.

9) Can I change my W-4 after I start working?

Yes, once employed, you can modify your W-4 at any point by providing it to the Human Resources (HR) or Payroll Department of your employer.

10) Do employers fill out the W-4 or W-2 form?

Employers provide W-2 forms, and employees are asked to complete W-4 forms.

FAQ's

How often do you get a W-2 form?

+

Your W-2 forms will arrive by January 31 for the previous tax year.

Do I get a W-2 if I’m self-employed?

+

Self-employed individuals do not receive W-2 forms from employers but will instead typically receive Form 1099-NEC from clients who paid them.

What information is included on a W-2 form?

+

A W-2 provides information regarding your name, Social Security number, employer details, total wages paid in 2016, as well as federal, state, and local withheld taxes for reporting purposes.

What happens if my W-2 has an error?

+

If your W-2 contains any discrepancies, notify your employer as soon as possible to get a corrected form (W-2c) before filing your tax return.

Is W-4 used for federal or state taxes?

+

A W-4 form is used for federal income tax withholding, though some states also require a separate W-4.