Direct deposit is one of the best methods to pay employees. This is the fastest way to access your paycheck quickly and easily, because the amount reflects right into your bank account.

For those new to direct deposit , the process may seem complex at first; most employers require that newcomers submit a voided check with their direct deposit form containing all essential banking details. However, there are several different ways to get check stubs if employers use voided checks as their direct deposit.

What is a Voided Check?

A voided check means the paper checks with “VOID” written clearly across their front. Once the checks are voided, they cannot be used to make payments or withdraw funds from an account – so why would anyone use such an invalid check?

Information printed on checks holds significant value, especially when they’re voided and still contain your routing number, account number, and check number. Employers, banks, and service providers often request voided checks when setting up direct deposit, automatic bill payments, or other electronic transfers, as it helps guarantee funds reach the appropriate accounts.

Also Read: How Many Hours is Part-Time? A Guide For Employers And Employees

What Does Void Mean on a Check?

Voiding either a blank check or one that has already been filled out is easy and secure, providing banking information in an encrypted manner. Once written with “VOID” on the check becomes ineligible for payment but still useful in sharing banking data securely.

Importance Of Voided Check

Voided checks play an indispensable role in daily financial tasks.

Employers require a direct deposit voided check while setting up direct deposits; lenders might need it when processing loan payments; utility providers, insurers and subscription services all use voided checks as auto-pay tools to help manage finances more efficiently.

Experienced checkbook users may find seeing a voided check sample helpful when trying to understand its purpose.

When a Voided Check Is Needed?

Voided checks are often necessary when providing accurate banking details for secure money transfers. These voided checks enable individuals and businesses to share account details safely without fear of unintended withdrawals from accounts shared with third parties.

Here are the most frequent scenarios where voided checks may be necessary:

1. Arranging Automated Bill Payments

Some companies, insurance agencies, loan providers, and subscription services often request a voided check to set up automatic bill payments using an ACH transfer. That helps to make sure bills are always paid on time!

2. Establish Direct Deposit

Employers often ask employees beginning new jobs or changing how they receive their paycheck stubs to provide a voided check. These voided checks contain your routing and account numbers so that salary deposits are made directly into your account without error.

3. Verifying Account Information

To validate your banking details, the tax agencies, student loan providers, or financial institutions may ask for a voided check as proof of your account.

4. Implement Payroll Services

Employers and payroll service providers often require a voided check to verify that your direct deposit information is entered correctly.

Also Read: What is STD on Paystub?

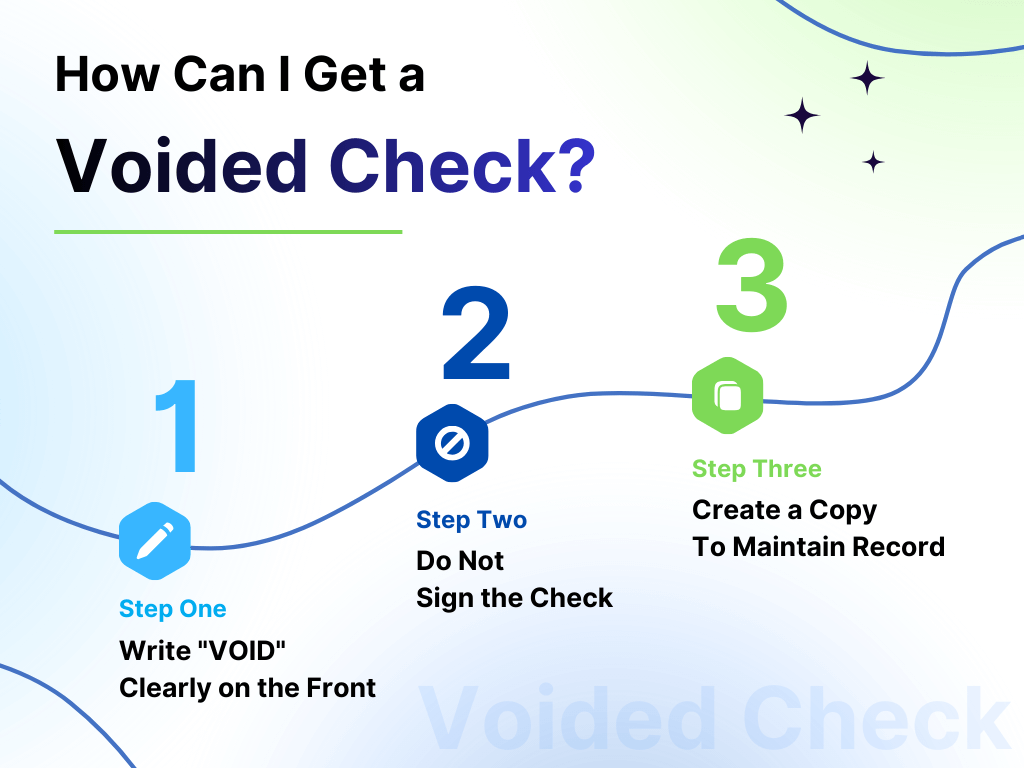

How Can I Get a Voided Check?

Voiding a check can be easy, but to protect your banking data, it must be done carefully and correctly. Here’s how you can void a check safely:

1. Write “VOID” Clearly on the Front

To mark out an invalid check, take a blue or black pen and write in capital letters “VOID” across its front. Do not cover up key information such as the routing number or account number at the bottom.

Your check can also be voided by writing “VOID” in smaller letters on key lines – such as the payee line, date line, amount box line, and signature line.

2. Do Not Sign the Check

Avoid signing a voided check by leaving the signature line empty; doing so reduces any chance that someone could misuse the check.

3. Create a Copy To Maintain Records

Once you void a check, take a copy or photo and save it in your records for future reference.

Also Read: How to Get Pay Stubs from Direct Deposit

How to Get a Voided Check for Direct Deposit?

Even without a checkbook, direct deposit can still be easily set up. Many banks offer the same information found on a voided check.

1. Talk With a Bank Representative

Most banks can print a check with a voided check template or a direct deposit form for you. That includes your account number, routing number, and other pertinent details needed by employers.

2. Consult Your Bank for Instructions

Some banks provide step-by-step instructions both online and in the branch that will enable you to set up direct deposit without using physical checks. They may even offer downloadable direct deposit forms you can give directly to employers.

3. Provide Bank Details

Many employers now accept direct deposit authorization forms as an alternative to voided checks, in which case you’ll need the following details in order to complete them:

- Bank account number

- Routing number

- Beneficiary name

- City/state location of the bank’s headquarters

Common Mistakes When Voiding a Check

Voiding a check may seem straightforward, but small errors could put your banking data at risk.

Here are the most frequently occurring errors to watch out for:

- Improper record-keeping could create chaos with your account records, leading to confusion.

- Writing “VOID” too small or light makes the check still appear usable. So write it clearly.

- Throwing the check away without first shredding it exposes your sensitive bank details and could potentially put your finances at risk.

Also Read: How Many Work Days In A Year? (2026)

What Are The Alternatives To a Voided Check?

Voided checks can often be the simplest and quickest way to set up direct deposit or automatic payments, but there are other solutions if paper checks don’t suit or you prefer not to void one. There are various other banking details sources that provide accurate details that provide similar results safely and accurately.

Consider using one of these as alternatives:

✅ Voided Counter Check

Some banks and credit unions, temporary “counter” checks can be printed at their branches for you.

✅ Direct Deposit Authorization Form

Most employers require employees to complete and submit a completed Direct Deposit Authorization Form with their routing and account numbers to enable direct deposits into their bank accounts. Be sure to double-check each digit carefully so as to prevent errors from occurring.

✅ Previous Paystub

The previous paystub can also serve as proof of banking details if it lists your routing and account numbers; many employers accept them when voided checks are unavailable. The pay stubs provide verified details directly from payroll records – making it a reliable alternative.

Key Takeaways

If you are wondering what does void mean on a check, this blog helps you to understand what they are for, how to void a cheque properly, and when you might need one.

A voided check offers secure banking information for direct deposits, auto payments, and other money management tasks. And if you don’t even have paper checks, there are plenty of safe alternatives like digital forms, a counter check, or previous paystubs that provide the same information.

Also Read: What is LTD on Paystub? A Complete Guide

People May Also Ask

1) Why do employers ask for voided checks?

Employers ask for voided checks so they can verify the proper routing and account numbers for direct deposits.

2) Can you cash a voided check?

No, you can not cash or deposit a voided check ever.

3) Can you get a voided check online?

Yes, several banks will let you obtain a voided check or something similar on the web.

4) How can I get a voided check without a checkbook?

You can obtain a counter check or direct deposit form, or you may also bring in a deposit slip containing your account number and provide it to the institution.

5) Can you create your own voided check?

Alternatively, you can make a voided check by writing “VOID” across the face of a check.

6) What can I use in place of a voided check?

In place of a voided check, you can use a direct deposit form, counter check, deposit slip, paystub with routing and account numbers or a photocopy of the initial page on your checking account book.

7) What qualifies as a voided check?

A check is considered void after the word “VOID” is written on it and its banking information remains legible.

8) Do you need a voided check for ACH?

ACH does not necessarily always require a voided check since most companies will also take direct deposit forms or digital account verification.

9) What are the reasons for voiding a check?

Checks can be canceled for purposes of establishing deposits, correcting writing mistakes, or preventing fraud.

Also Read: Top 7 Compliance Tips When Using A Free Paystub Generator

FAQ's

What does a voided check look like?

+

A check that has been voided takes the same appearance as a regular written check with “VOID” printed across the front. In this check, all essential banking information is still visible.

How to void check for direct deposit?

+

To void a paycheck for direct deposit, write the word “VOID” in capital letters across it and do not sign your name.

What's voided check?

+

A voided check is nothing more than a check that has the word “VOID” written across its face so that it cannot be used to make payments, but it can still show someone what your bank account details.

How to get a copy of voided check?

+

You can obtain a copy of a voided check by asking for one from your bank, printing it through an online banking service platform.

Where To Get voided check?

+

You can obtain a voided check from your bank, online banking portal, or even your own checkbook.

Can you go to the bank and get a voided check?

+

Yes, you can print a voided or counter check at the branch of your bank.

How do you get a voided check online?

+

You can obtain a voided check online using your bank’s website, by downloading a direct deposit form, or by printing blank checks.

Why would you void a check?

+

Checks are destroyed in order to securely manage banking details for direct deposit, ACH transfers and auto-pay options.

What can someone do with a voided check?

+

A voided check is not payable and cannot be cashed, but it still has banking numbers on it your accountant or employee could use.