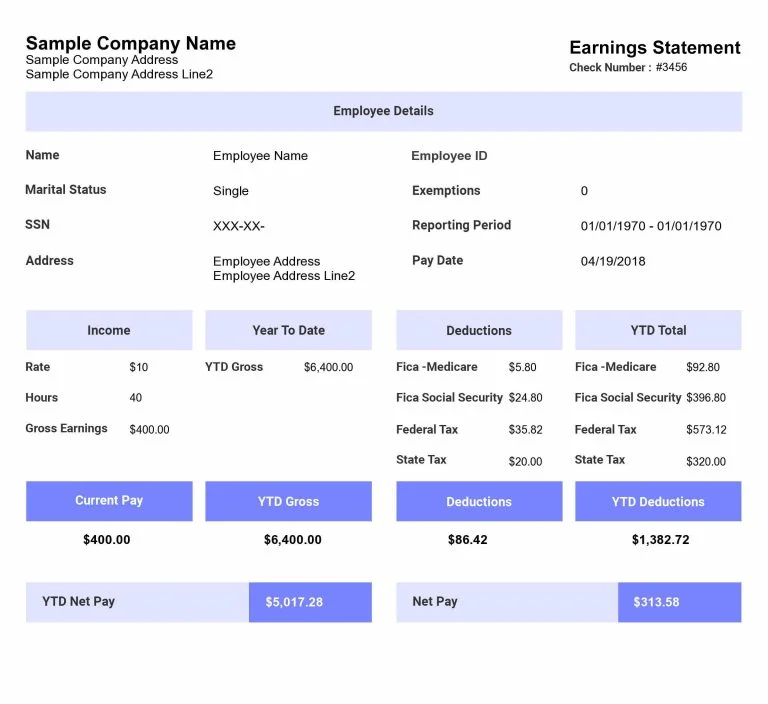

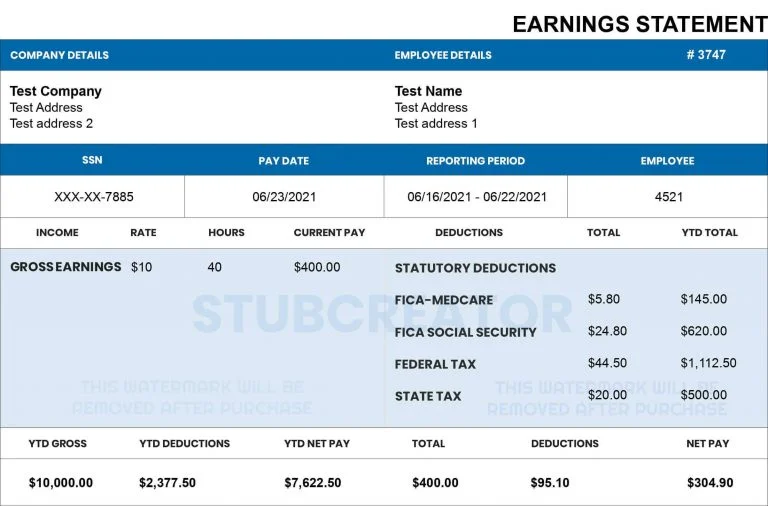

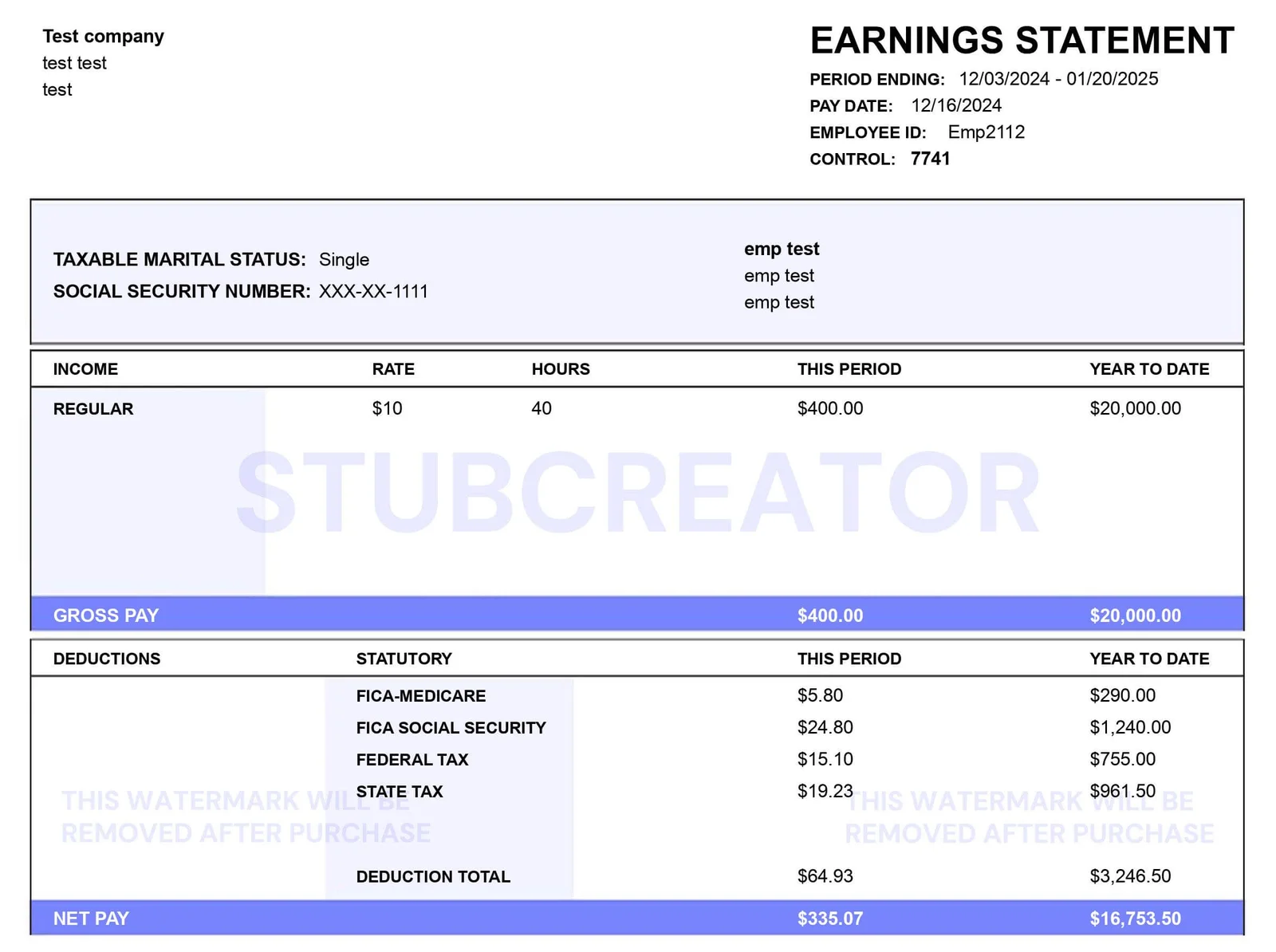

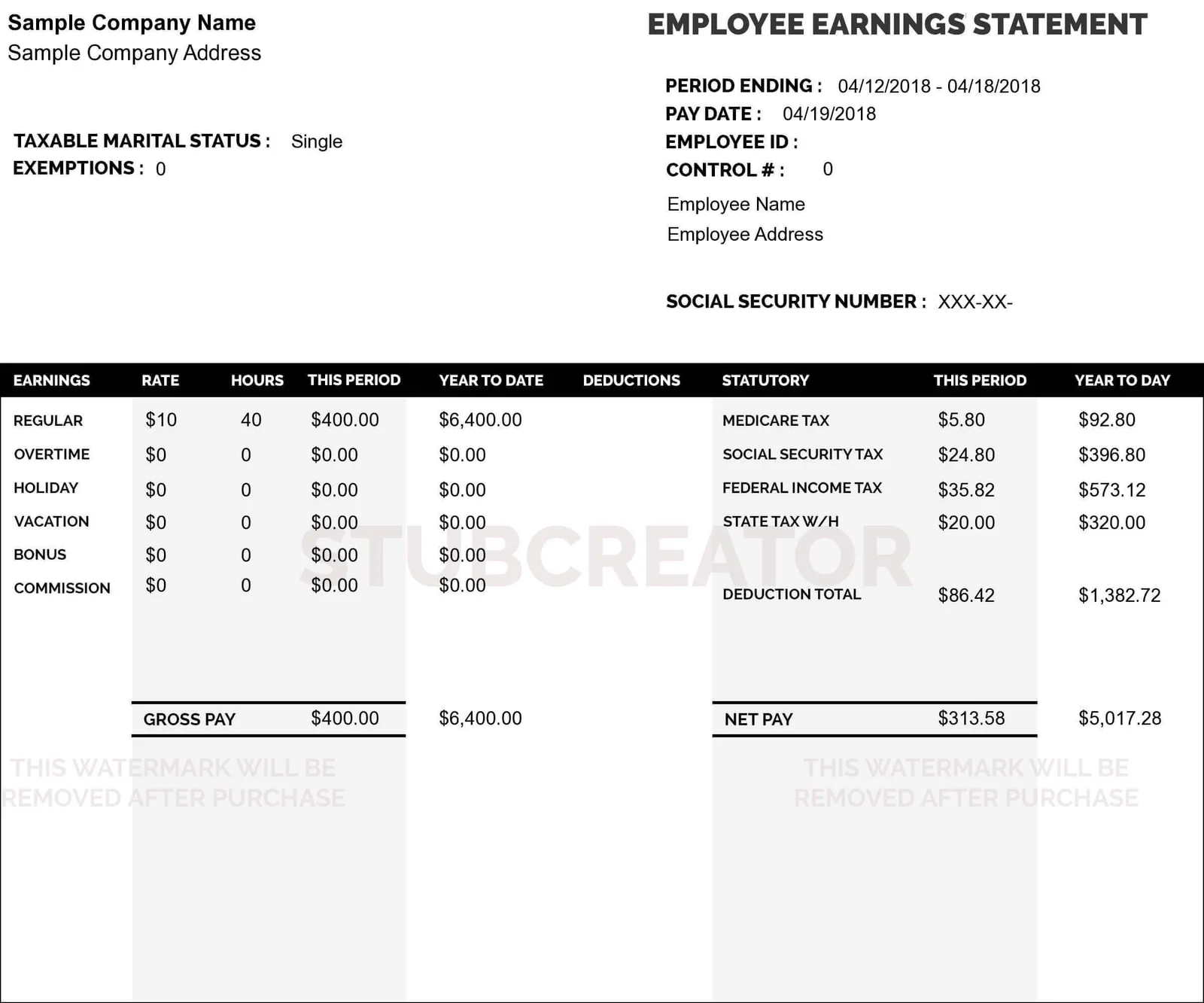

$25000 Tip Deduction: How to Show Tax-Free Income on Paystub

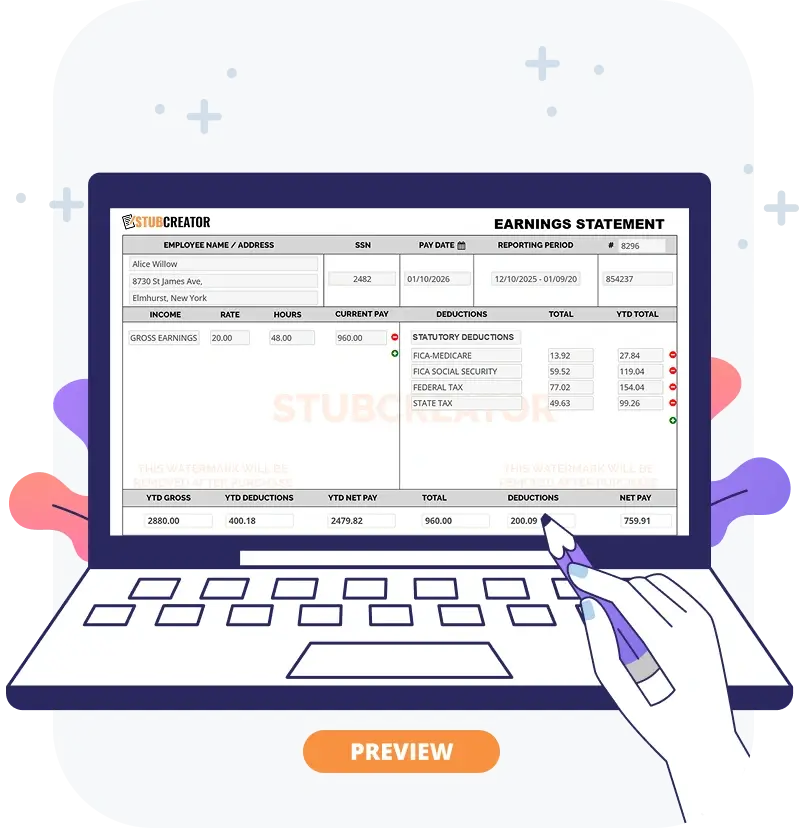

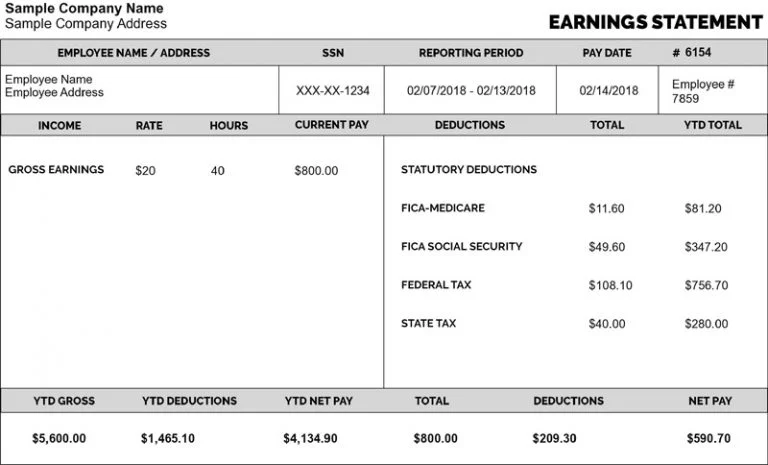

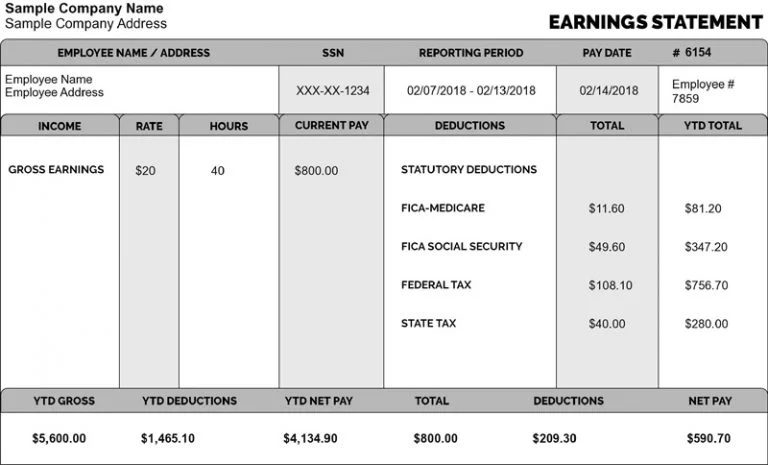

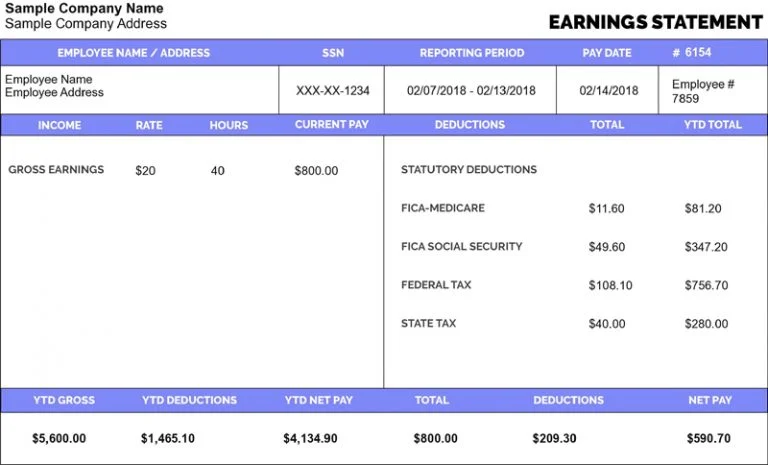

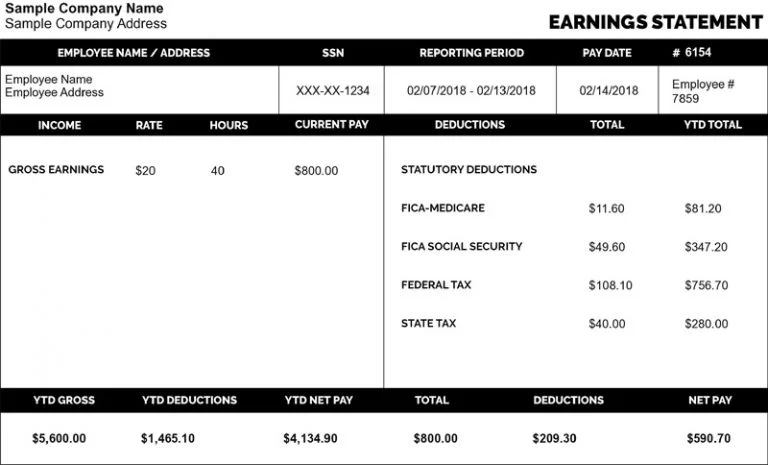

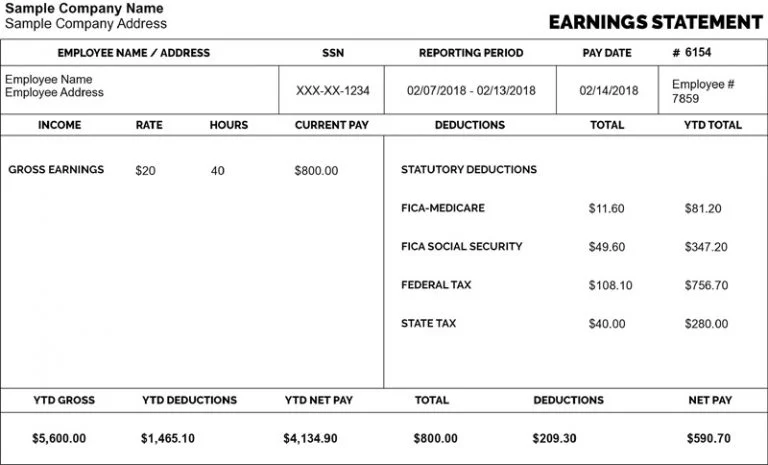

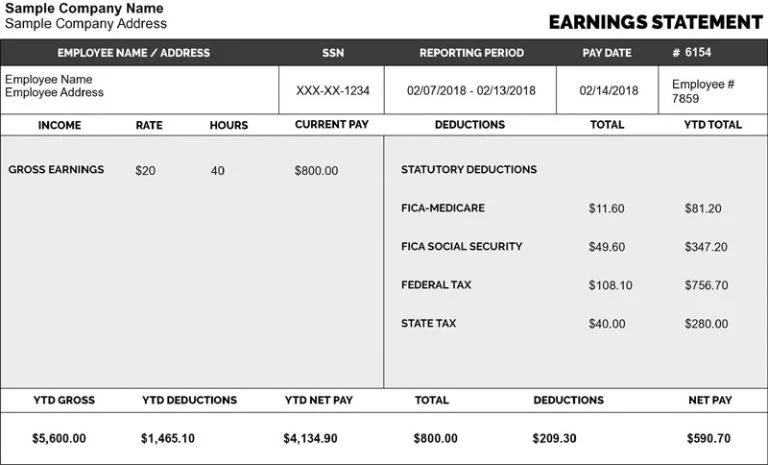

Summary: The $25,000 tip deduction allows eligible tipped employees to reduce taxable income, but it can create challenges when proving income for loans. Lenders rely on properly formatted…

Posted On: Feb 03, 2026