Employing a free paystub generator is one of the simplest and cost-effective methods for small businesses, self-employed, and independent contractors to generate accurate paystubs without investing in costly payroll software.

As you know, Pay stubs are legal documents, and any inaccuracy in them could result in payroll disputes, employee dissatisfaction, and tax issues or penalties.

Therefore, businesses must understand and adhere to all federal and state requirements when creating pay stubs while using a free pay stub creator. Read the blog to know more about the paystub generation; this helps maintain transparency, avoid errors, and protect both employees and employers against potentially disastrous errors.

Why Compliance Matters When Using a Paystub Generator

A paystub creator creates accurate pay stubs quickly; however, it should be compliant. Compliance is vital since pay stubs are legal documents with legal implications attached.

Complying with all regulations helps your company remain transparent, prevent tax issues,and ensure employees receive accurate pay information.

Also Read: Is Free Paystub Generator Legal in 2025?

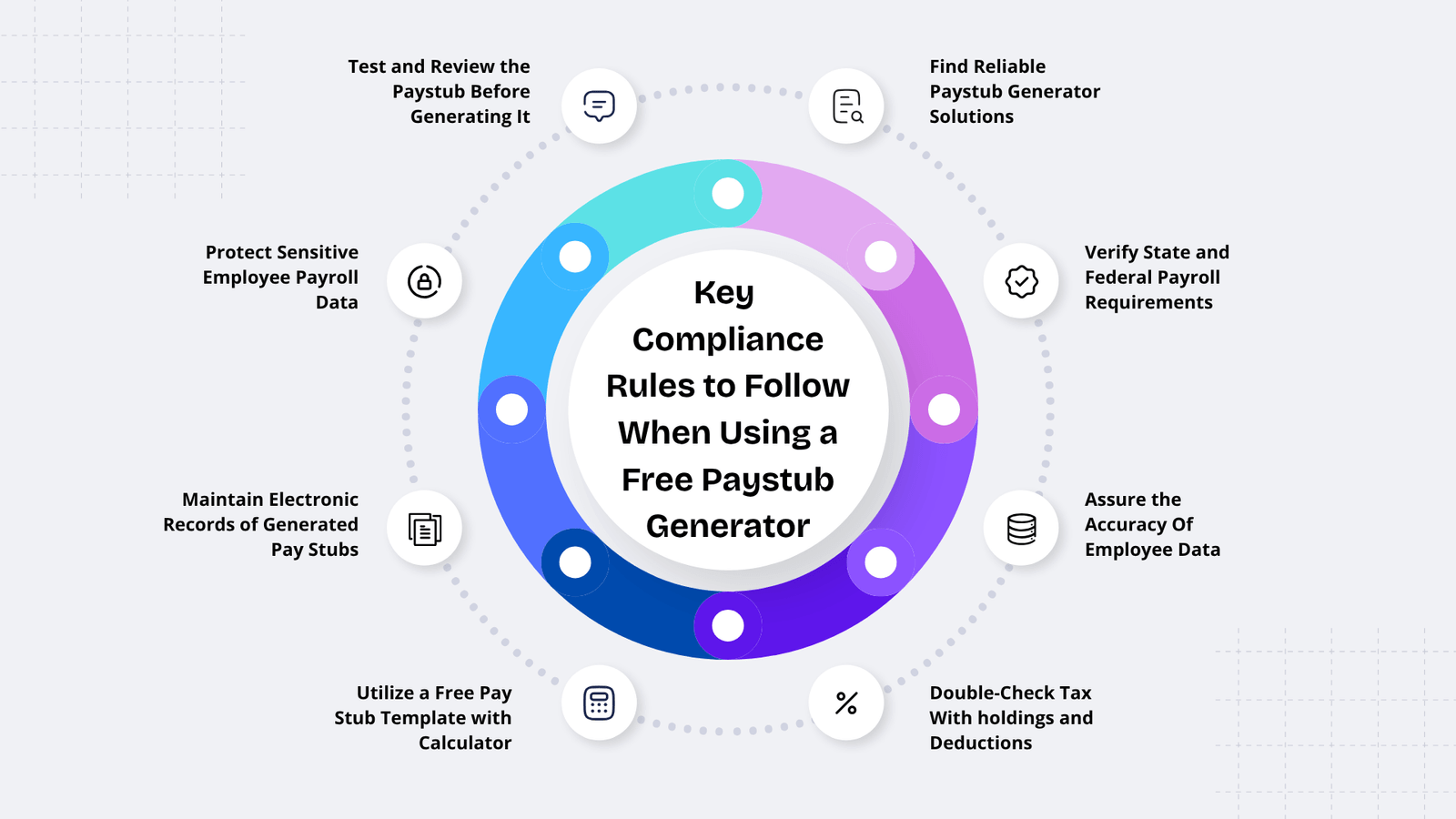

Key Compliance Rules to Follow When Using a Free Paystub Generator

Check the important compliance tips to generate pay stubs by using the tool.

1. Find Reliable Paystub Generator Solutions

The paystub generator free tools may vary greatly in terms of:

- quality,

- features

- tax calculation &

- accuracy.

You need to find a reliable free paycheck stub maker should offers an accurate paystub, up-to-date tax rates, secure data management, and a clear, professional layout that adheres to state and federal requirements.

Many free paystub generators may seem appealing but may lack essential compliance features – like deducting deductions properly or tracking benefits – which could cause payroll errors.

Before selecting a free paystub creator tool, be sure it offers automated calculations, customizable templates, and clear data policies. Also helpful are tools with user reviews, clear instructions, and customer support services.

2. Verify State and Federal Payroll Requirements

Payroll compliance begins by understanding state and federal labor laws. Each state has different minimum wages, overtime pay rates, paid leave policies that must be observed for legal stub generation.

A free paycheck generator should adhere to these regulations when producing legally valid pay stubs. Under federal labor law (the Fair Labor Standards Act or FLSA), employers are obligated to maintain accurate records of earnings, hours worked and deductions from earnings.

An effective free paystub generator tool must use accurate federal tax tables to calculate Social Security, Medicare, and federal income tax payments correctly. Verifying that it complies with state and federal requirements ensures your pay stubs remain compliant and accurate.

3. Assure the Accuracy Of Employee Data

Pay stub accuracy is of utmost importance when creating pay stubs. There are several mistakes you can find, such as any discrepancies, mispelled names, wrong addresses, or inaccurate pay rates could lead to significant complications.

Before entering information into a pay stub generator free tool, double-check employee details like their full legal name, Social Security Number, work classification, pay frequency and any voluntary deductions.

Any incorrect data could result in mismatched tax records, W-2 errors, or wage disputes that arise as a result. Since free generators do not validate data, it’s up to you to make sure everything is correct. Taking an extra few minutes now can prevent costly errors and protect both sides against payroll problems later.

Also Read: Form 1099 NEC vs 1099 MISC: What Is The Difference?

4. Double-Check Tax Withholdings and Deductions

Even when using a free paystub generator, it’s still wise to review all tax withholdings and deductions carefully. Some tools may miscalculate or fail to update tax tables properly, leading to incorrect Social Security payments, federal income tax, Medicare costs, or state-specific taxes being withheld or deducted. Employers are accountable for verifying that all deductions are accurate, regardless of which tools are employed to accomplish this goal.

You should also monitor voluntary deductions such as retirement contributions, dental or health insurance premiums, wage garnishments, and union dues payments. Maintaining compliance involves regularly reviewing each calculation against official tax tables or your payroll records to ensure accurate deductions.

5. Utilize a Free Pay Stub Template with Calculator

A free pay stub template with a calculator simplifies payroll and helps prevent mistakes in calculations involving gross pay, overtime pay, taxes, and net earnings.

Manual calculations introduce errors into this data, while auto-fill and built-in formulas ensure all figures remain consistent and accurate. The paystub creator often automates federal taxes, FICA contributions, and basic state taxes, making the process faster and more reliable for small businesses or freelancers.

You can also use the paystub template to generate pay stub much simply, helping you meet formatting requirements and maintain professional records. When choosing a free template, ensure it contains fields for hours worked, earnings, deductions, taxes, year-to-date totals and employer information.

6. Maintain Electronic Records of Generated Pay Stubs

Employers are required to retain all employee payroll records by federal law; some states mandate longer retention. Digital copies make it easy to access past paystubs for audits, tax filings, or employee inquiries.

When using a paystub generator tool, however, each document must be actively saved, since some do not automatically save data.

Organising digital records helps reduce confusion and ensure you can quickly provide proof of wages when requested by the IRS, state agencies, or employees.

7. Review the Paystub Before Generating It

Prior to finalizing and distributing pay stubs, be sure to conduct a comprehensive review. Check for calculation accuracy, correct formatting, and complete information.

A free paystub maker may autofill or round amounts incorrectly, making manual verification essential. Careful review helps prevent mistakes that could cause payroll disputes, tax issues, or legal liabilities in your workplace.

Conclusion

A free paystub generator can be an extremely helpful tool in quickly, professionally, and comprehensively producing pay stubs, but its use must be done responsibly to meet compliance standards.

Payroll records play an integral role in taxes, legal documentation, and business audits. So choose a reliable check stub generator, verify laws, and protect employee data before reviewing every detail carefully. This can help to create accurate and fully compliant pay stubs that build trust among your staff while simultaneously adhering to state and federal regulations.

Curious Minds Ask:

1) Are free paystub generators safe to use?

A free paystub generator can be trusted when choosing an established tool with secure data protection measures in place, including HTTPS security protocols, privacy policies, and the latest tax features.

2) What is the most important information on a pay stub?

Key details in payroll processing include employee information, gross pay, deductions, taxes, and net pay – these elements ensure accuracy, transparency, and compliance with payroll laws.

3) Can you create a pay stub for free?

Yes, online paystub generators or free pay stub templates with calculators allow users to generate pay stubs for free. Just ensure the tool complies with current tax rules.

Also Read: How To Generate The Accurate And Professional Paystub?

FAQ's

Can AI create a paystub?

+

AI can assist in the production of pay stubs by organizing information and calculating earnings and deductions; however, accuracy in compliance and tax accuracy remains dependent upon inputted data.

How are fake pay stubs detected?

+

Fake pay stubs can often be identified through improper formatting, mismatched numbers, or missing employer details. Furthermore, lenders also verify employment records and income directly.