When it comes to tax reporting, Forms W-2 and W-9 serve different purposes and are used in different scenarios. It’s important to understand the difference between these forms for accurate tax filing, whether you’re an employer, employee, or contractor.

In this guide, we’ll break down the main differences between Form W-2 and Form W-9 to help you understand the requirements and ensure compliance with IRS rules.

Note: Whether you’re managing employee payroll or contractor payments, using a paystub generator can help maintain accurate wage records that support proper tax reporting.

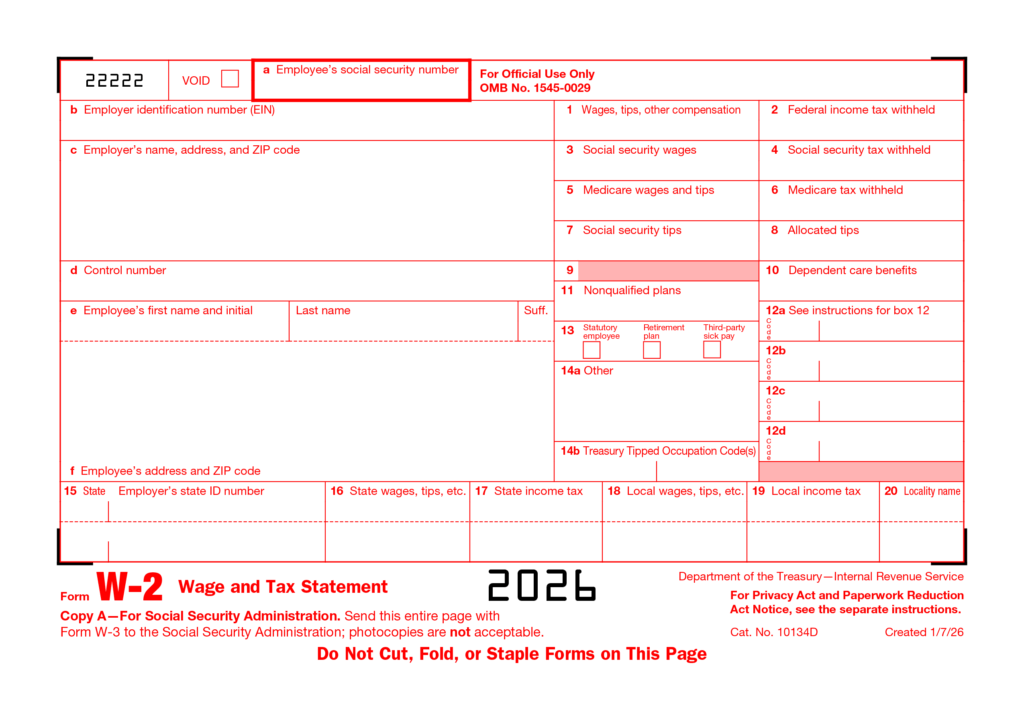

What is a W2 form?

W2 form is an annual information return that is provided to an employee that lists taxable wages and income tax withholding, and withholding of Social Security and Medicare taxes. This form also lists various employee benefits and any state income tax withholding.

The form also includes details about various employee benefits and any state income tax withheld. It is the employer’s responsibility to file a W-2 form for each employee reporting the total wages earned during each pay period, regardless of total compensation earned during the year.

Employees then use the information on the form to file their federal and state taxes. Employers are also required to submit copies of the W-2 to the Social Security Administration.

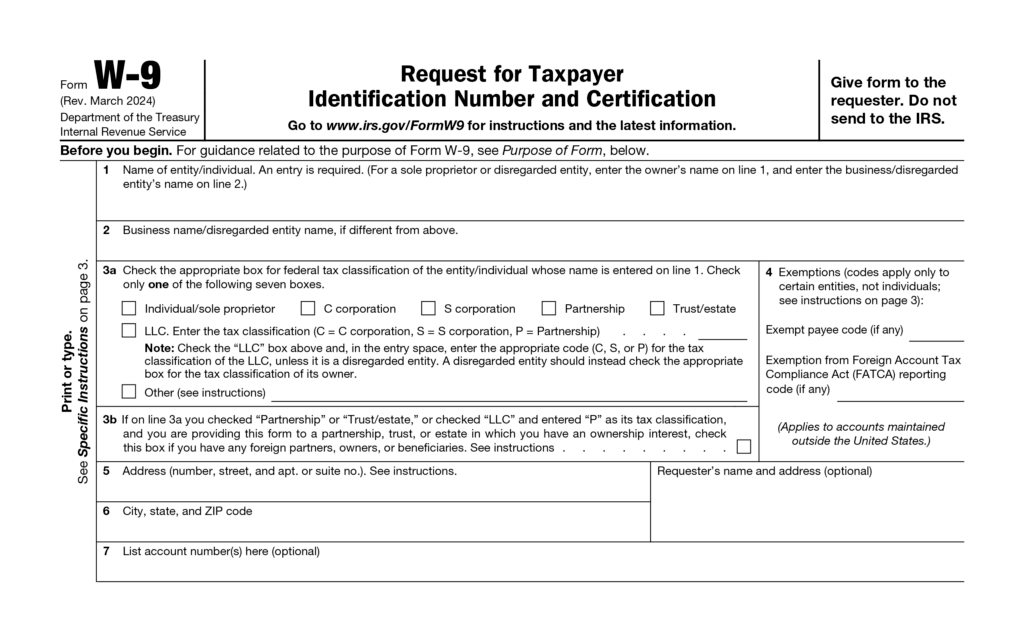

What is a W9 form?

Form W-9, also known as the request for Taxpayer Identification Number and Certification, is an IRS form used by independent contractors or non-employees to provide their personally identifiable information, such as an individual’s Taxpayer Identification Number or a business’s Federal Employer Identification Number. It can also be used to report various other payments to the IRS, including IRA contributions or mortgage interest.

The W-9 form does not include tax withholding information because independent contractors are responsible for filing and paying their own taxes. However, if they are subject to backup withholding, they must indicate it on the W-9, reporting the business withholding 24% income tax from any payments.

What is the purpose of form W2?

The W-2 form is used by employees to report their wages, tips, and other compensation, as well as taxes withheld from their pay. It is required for filing both federal and state tax returns. Employers use it to report wages paid to employees and the amount of tax withheld, ensuring proper tax compliance with the IRS. Purpose of W2 form:

1. How much have you earned

It shows your total wages, tips, and other compensation earned during the year.

2. Report taxes already paid

It shows how much your employer withheld for:

- Federal income tax

- State income tax

- Social security tax

- Medicare tax

3. Help you file your tax return

You can use the information on your W-2 form to accurately file your income tax return with the IRS.

4. Allow the IRS to verify income

IRS receives a copy of your W-2 form to confirm:

- Your reported income is correct

- Taxes were properly withheld and paid

What are W2 Forms used for?

A W-2 form is used for the following purposes:

- Filing Income Taxes: Employees use their W-2 form to file state, federal, and local income tax returns accurately.

- Reporting Wages to the IRS: Employers send a copy of the W-2 form to the IRS and the Social Security Administration to legally report the income of employees.

- Monitor Tax Withholdings: W-2 forms should show how much is withheld for: Federal income tax, state and local income taxes, Social Security, and Medicare taxes.

- Verifying Income: W-2 forms are used as proof of income for Loans, renting an apartment, and financial aid applications.

- Ensuring Legal Compliance: They help ensure that employers are properly withholding taxes as required by the law.

What is a W9 Used For?

W9 forms are used for the following purposes:

- Report non-employee income: Businesses use W-9 form details to issue Form 1099-MISC for freelancers and contractors.

- Verify taxpayer identity: It confirms your legal name, tax classification, and TIN to avoid reporting errors.

- Prevent backup withholding: Accurate W-9 information helps ensure that the IRS does not require 24% backup withholding on your payments.

Who Receives a W-2?

The following entities receive a W-2 form:

- Full-time employees

- Part-time employees

- Seasonal employees

- Employees who have worked for multiple employers

You receive a W-2 form if:

- You’re a W-2 employee

- Your employer withheld taxes from your paycheck

- You have earned any taxable wages during the year

Who Receives a W-9?

Before engaging with an independent contractor or freelancer, a business should ask them to fill out Form W-9 before signing any agreements or starting any projects. The business should retain the form for its records and use the details to prepare a 1099 form. There is no need to submit or send copies of the form to the IRS.

How to fill out a W2 Form?

If you want a W2 form for your business, you can visit the IRS website and download it from there. But if you want an automated system for your business, you can visit our website to create a W2 form for you.

To fill out a W2 form, do the following:

- Visit our website- W2 form generator

- Insert employee information

- Insert employer information

- Fill in wages & tax amounts

- Insert state & local tax details

- Download your W2 form

How to fill out a W9 Form?

To fill out a W9 form, do the following:

- Write the name as shown on your income tax return.

- Write the business name.

- Fill out the federal tax classification for the person whose name is entered on line 1.

- Include any exemption codes.

- Write the business’s address.

- Write the business’s city, state, and zip code.

- List account numbers.

Difference Between W9 vs W2 Form

| Factors | W2 Form | W9 Form |

|---|---|---|

| Motive | Form W-2 is used by employers to report employee wages and tax withholdings to the IRS. | Payers use Form W-9 to collect taxpayer identification information from independent contractors or vendors in order to accurately file 1099s. |

| Who uses it? | Employers hire individuals as full-time employees for a business. | Businesses That Hire Independent Contractors Or freelancer. |

| Filing Responsibility | Employers file Form W-2 with the SSA and distribute copies to employees. | Form W-9 is not filed with the IRS; It is kept by the payer for record-keeping purposes. |

| Deadline Filing | Filing with the IRS on January 31 each year and distributing copies to employees. | There is no deadline for filing Form W-9; Businesses must collect it when hiring an independent contractor or filing Form 1099. |

| Tax Withholding | This includes federal and state income taxes, Social Security, and Medicare taxes withheld. | This includes stopping the backup. |

How Can I Get a Copy of My W-2 Online?

To get a copy of your W2 online, you can use the W2 form generator, which can be helpful for employees.

You should visit the W-2 form generator. Follow the steps to create it online:

- Fill out the details on the W-2 form online.

- Click on Preview. If it is looking good, you can proceed to checkout, and if it has any errors, you need to edit it.

- After checking out, you get an email at your registered email address, from which you can easily download it in PDF format.

Also Check: For those who want to understand how wage information is typically displayed, reviewing a paystub template can provide a clear preview of common pay stub details used for payroll and tax reporting.

Form W-2 and W-9 Process Made Easy with StubCreator

StubCreator makes it easier than ever to manage payroll and contractor forms. Whether you’re handling W‑2 forms for employees or W‑9 forms for independent contractors, we provide the tools you need to stay organized and compliant. Accurate, hassle-free form management we offer built-in features to ensure accuracy, including TIN verification and internal audit checks.

This tool helps reduce mistakes that could trigger IRS inquiries, giving you confidence that your forms are accurate. By using our tool, you can generate and distribute W‑2s or pay stubs quickly, ensuring employees and contractors receive their copies on time with no manual paperwork required.

Key Takeaways

Understanding the difference between W-2 and W-9 forms is important for both employers and workers. W-2s are for employees and report wages and tax withholdings, while W-9s are for independent contractors, providing taxpayer information for accurate 1099 reporting.

Using the correct forms ensures compliance with IRS rules, prevents penalties, and streamlines tax reporting. We can simplify the process, making it easier to generate, manage, and distribute these forms accurately and on time.

People May Ask

1) How do you know if you need a W9?

You need a W-9 form if you’re a business that pays an independent contractor, freelancer, or sole proprietor more than $600 in a calendar year for services. Collecting their tax information is necessary for filing Form 1099-NEC with the IRS. W-9 must be requested before work begins.

2) Do W-9 ever expire?

The W-9 form is not required annually because it has no expiration date. It remains valid as long as the information on it is accurate. You can only request a new one if the seller changes or updates any information.

3) Who is not required to fill out a W-9 form?

W-9s are not required for corporations (in many cases), government entities, non-profits, foreign vendors, and payments for goods rather than services.

4) What is a W-2 job in the USA?

A W-2 employee is an employee whose employer deducts taxes from their wages and reports their annual earnings to the IRS using a W-2 form. These workers are generally entitled to benefits and protections under labor laws.

5) Who can work on W-2 in the USA?

W-2 employees are individuals who work directly for your organization, with taxes such as federal income tax, Social Security, and Medicare deducted from their pay by the employer. Employers are responsible for providing benefits such as health insurance and paid leave to W-2 employees.

Also Read:

Pennsylvania Paycheck Calculator

FAQ's

Is W9 the same as W2 form?

+

No, both forms are not the same. The W-2 reports employee wages and withholdings to the IRS, while the W-9 provides taxpayer information for independent contractors so that a 1099 can later be issued. They serve different types of workers, are filed by different parties, and are never interchangeable.

How to fill out a w9 form?

+

Filling out the W-9 form is straightforward. Start by entering your full name and business name (if applicable) in the top fields. Select your tax classification. Provide your address, city, state, and ZIP code, then enter your Taxpayer Identification Number, either your Social Security Number or Employer Identification Number. Sign and date the form to certify that the information is correct. Make sure all details match IRS records to avoid delays in payment or reporting.

What is the purpose of w9 tax form?

+

The W-9 tax form is used by US businesses to collect taxpayer identification numbers and other information from independent contractors, freelancers, or vendors. This information helps the business report payments to the IRS and issue forms such as 1099s at the end of the year. Basically, it ensures accurate tax reporting and compliance.

What is a W-2 in simple terms?

+

The W-2 form is a United States federal wage and tax statement that an employer must provide to each employee and also send to the Social Security Administration (SSA) each year. Your W-2 wage and tax statement lists your total annual wages and the amount of taxes withheld from your pay.

What is W2 employee?

+

A W-2 employee is an employee employed by a company who receives a regular paycheck with taxes automatically withheld, including income tax, Social Security, and Medicare. The employer provides a W-2 form at the end of the year, which summarizes the employee's total earnings and taxes paid, which is used to file their annual tax return. Unlike independent contractors, W-2 employees are usually eligible for benefits such as health insurance, retirement plans, and paid vacation.

What is the purpose of Form W-2?

+

The purpose of Form W-2 is to report an employee’s annual wages and the taxes withheld by their employer. It helps employees accurately file their federal and state income tax returns and ensures the IRS receives the correct information about earnings and tax contributions.

Why is my W-2 rejected?

+

Some common mistakes that can cause rejection are a mismatched name, SSN, employer EIN, electronic signature number, or an expired TIN. File early. Another step that should be taken is to file your returns early. This gives identity theft criminals less time to file fraudulent returns using your information.