Most of the people are confused among several terms like pay stub, pay slip, pay check, etc. Here, we are going to explain all the relevant things regarding pay stubs. Understanding your pay stub becomes vital as it serves as proof of income by outlining exactly how earnings are calculated.

“Pay stub shows outline of gross pay, taxes deducted, deductions made and net pay amounts.”

In this section, we’ll guide you through each component of a pay stub to help you understand its meaning and its importance – whether that’s as an employee, freelancer or employer managing payroll – knowing how to read it can provide transparency, accuracy and financial awareness for both you and your employer.

What Do Pay Stubs Mean?

Pay stubs are formal documents issued by employers that outline the breakdown of your salary for any given pay cycle, serving as proof that deductions have taken place. In other words, pay stubs serve as mini income statements where gross income represents your overall earnings, while net income refers to how much is actually received as pay.

Pay stubs are provided by employers either with checks or direct deposits into bank accounts, and vary in terms of organization and content between companies. Workers benefit from having easy access to their earnings and deductions, while employers find them an efficient way of keeping payroll records for reporting purposes as well as regulatory needs.

A pay stub typically includes:

- Employee data, such as name and identification number.

- Employer information – SSN number.

- Beginning and end of payroll periods.

- Regular hours worked, overtime hours worked, and other hours worked.

- Gross pay before deductions.

- Total deductions, year-to-date earnings.

- Hourly pay rate or salary amount.

- Federal and state withholding taxes.

- Deductions include insurance, Medicare, and Social Security.

- Retirement or pension scheme contributions.

- Wage garnishments (child support, for example).

- Net pay is what you receive after all deductions.

Understanding each section of a pay stub not only helps you verify your pay but also ensures financial precision, conformity, and tranquillity. Let’s understand the pay stub.

Why Do You Need a Pay Stub?

Pay stubs are essential for bringing financial transparency and accountability, providing assurance that your paycheck accurately reflects all of the hours worked. That includes overtime, bonuses, and any extra earnings – along with deductions, taxes, and contributions being properly applied.

- By checking pay stubs periodically, you can ensure all deductions, tax withholdings, and contributions have been applied as necessary.

- Pay stubs can also help monitor tax withholdings, plan tax filings, and conduct personal financial audits.

- As proof of income, they’re often required when applying for loans, mortgages, or lease agreements.

- A plus pay stub provides important long-term financial planning insights, allowing you to track pension savings, insurance benefits, and other key considerations.

Simply stated, knowing and understanding your pay stubs ensures the accuracy, transparency, and control over your financial well-being.

Paystub In The USA: Everything Employers And Employees Need To Know

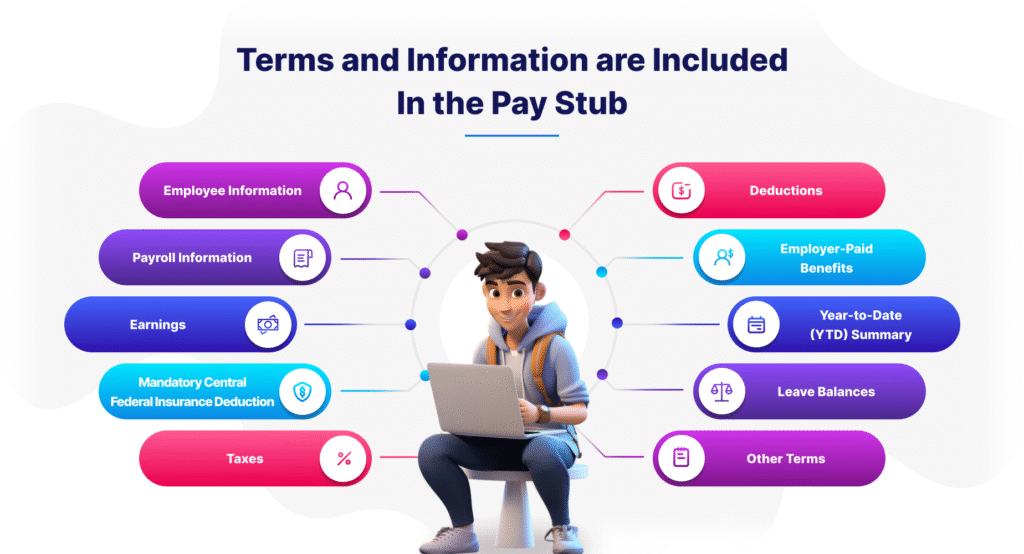

Terms and information Are Included In the Pay Stub

Pay stubs provide more than evidence of payment–they also give an itemized breakdown of your income, deductions, and benefits. Each section explains how your pay is computed and helps ensure it’s correct; knowing these factors is key to effective money planning and payroll disclosure.

Employee Information

This field helps you to add information about yourself within your organization and ensures payroll accuracy. Employee Name and Mailing Address are verified as proof of identification for payroll purposes. By providing information relevant to both individuals and work tasks that HR and payroll can use it for pay stub documentation.

- Employee ID: Your unique identification number issued to you by the organization.

- Department: Your department or division.

- Location: Where your work takes place (office or geographical).

Payroll Information

In a pay stub, the payroll section contains essential dates pertaining to your wages, helping ensure it reflects the appropriate work period and that payments are made on time. Furthermore, it monitors when payments have been made so that payments may be issued at their proper intervals.

- Pay Period: The pay period refers to the dates on which your salary is calculated and paid into your account – typically weekly, bi-weekly, or monthly.

- Pay Date: This refers to when it will actually arrive in your bank account or wallet.

Earnings

This section describes how your compensation is calculated based on the hours worked and extra pay. It ensures that all regular, overtime, and bonus pay are properly accounted for.

- Regular Pay and Hours: Regular hours worked and wages.

- Overtime Pay and Hours: Pay for overtime hours worked plus extra pay as an overtime premium.

- Gross Pay: Income before deductions.

- Extra Earnings: Bonuses, Commissions, Incentives, or Other Forms of Bonus Pay.

Taxes

Below are listed your withheld taxes from your salary, including national, state, and local program contributions. This section is publicly displayed for both transparency purposes as well as to check for proper withholding amounts.

- Central/Federal Taxes: Government-imposed taxes withheld according to regulations.

- State or Province-specific Taxes: Where you work, local government taxes (if any), as well as Social Security and Medicare contributions, will all be withheld from your paycheck for withholding purposes.

Mandatory Central/Federal Insurance Deduction

Some deductions are mandatory to meet government compliance, including national pension, insurance, and social benefit plans, in a physical or online paystub. Deductions typically accrue for long-term coverage by meeting national insurance plans.

- Either federal or national plans.

- These provide long-term coverage and have no bearing on employer-specific plans.

- Deducted funds tend to be portable between employers.

Guarantees can include pensions, disability coverage, and other benefits in the future.

Deductions

Deductions refer to amounts withheld from gross earnings, both pretax and posttax, that reduce take-home pay – knowing these deductions accurately ensures greater accuracy of accounting.

- Pre-tax deductions: health insurance premiums, retirement contributions, and other benefits taken out before taxes.

- Post-tax deductions: Union dues, garnishment, or court-ordered payments taken out after taxes. Explain to employees how deductions impact net pay.

Employer-Paid Benefits

Employers sometimes offer benefits to workers as part of their overall compensation package.

- Health insurance benefits: Benefits might include employer-paid health and dental coverage contributions.

- Retirement benefits: Retirement contributions such as pension plans or 401(k).

Year-to-Date (YTD) Summary

Here, your earnings, deductions, net pay, and year’s cumulative totals are tabulated along with any year-end totals to monitor your total income and plan your finances effectively.

- Total deductions: Total deductions include contributions and taxes withheld from gross pay.

- Gross pay: Gross pay refers to gross income before deductions have been deducted.

- Net pay: Net pay in a pay stub is what remains after deductions, and year-to-date totals represent earnings, taxes, and deductions since January 1.

Leave Balances

Leave balances are used to monitor leave entitlement and provide useful planning of time off and monitoring information for planning purposes.

- Vacation or PTO leaves: This balances the offer available days for personal use.

- Sick leave: It shows any unused sick days remaining.

Other Terms

Other terms may also be displayed depending on your work or legal needs, giving a comprehensive picture of all transactions affecting your salary.

- Corrected Pay or Back Pay: Corrected or outstanding payments from previous periods.

- Garnishments: Mandatory court deductions such as child support or alimony payments.

- Insurance contributions: Employee-specific payments made towards optional benefits.

Wrapping Up

Pay stubs are relevant to both employers and employees. Employees, with the knowledge of all facets of a pay stub, feel empowered to control their finances, track earnings, and make intelligent provisions for the future. Employers, through the application of a sure pay stub generator, ensure accuracy and reduce errors in payroll processing, thereby increasing efficiency and employee satisfaction.

Modern payroll and HR solutions such as Keka make it even simpler by automating payroll, ensuring compliance, and issuing detailed pay stubs. Through a simple-to-use ESS portal, organizations can make transactions more transparent, function more efficiently, and provide employees with complete and clear financial data, establishing trust and efficiency within the workplace.

Common Questions People Might Ask

How Can I Correct An Error In a Paystub?

If you spot mistakes on your pay stub, If you notice an error on your pay stub, inform your payroll department or employer so that they can investigate and provide a corrected version. Or if you are using a free pay stub generator, then you can get the preview and solve the error.

Can I Generate My Paystub?

Yes, you can create your own pay stub with an online pay stub generator for creating pay stubs by entering precise income and tax information.

How Are Paystub Generators Useful?

Paystub generators assist in creating accurate, professional pay stubs fast by reducing time and mistakes that are made manually.

Are Pay Stubs And Pay Statements The Same?

Yes, the pay stubs as well as pay statements are similar; they both display earnings, deductions, and information about net pay.

Can Pay Stubs Be Used As Proof Of Residency?

Generally speaking, pay stubs cannot be used to prove residency unless they contain an address, and they are deemed acceptable by the verifier.

What do Pay Stubs Look Like?

Pay stubs are a record of the details of your employer, such as pay period, pay amount, taxes, deductions, as well as net income.

FAQ's

What is a pay stub and why is it important?

+

A pay stub is a document that shows an employee’s earnings and deductions for a specific pay period. It’s important because it helps verify income, track taxes, and ensure payroll accuracy.

What does “gross pay” mean on a pay stub?

+

Gross pay refers to the total amount an employee earns before any deductions, such as taxes, insurance, or retirement contributions, are taken out.

What are deductions listed on a pay stub?

+

Deductions include items such as federal and state taxes, Social Security, Medicare, health insurance, and retirement plan contributions. These are amounts subtracted from gross pay to determine net pay.

What is “net pay” or “take-home pay”?

+

Net pay, often called take-home pay, is the amount an employee actually receives after all deductions. It’s the final amount deposited into their account or given via paycheck.