How It Works?

Enter Your Information

Enter Your Information

Preview Your Document

Preview Your Document

Download Document Instantly

Download Document Instantly

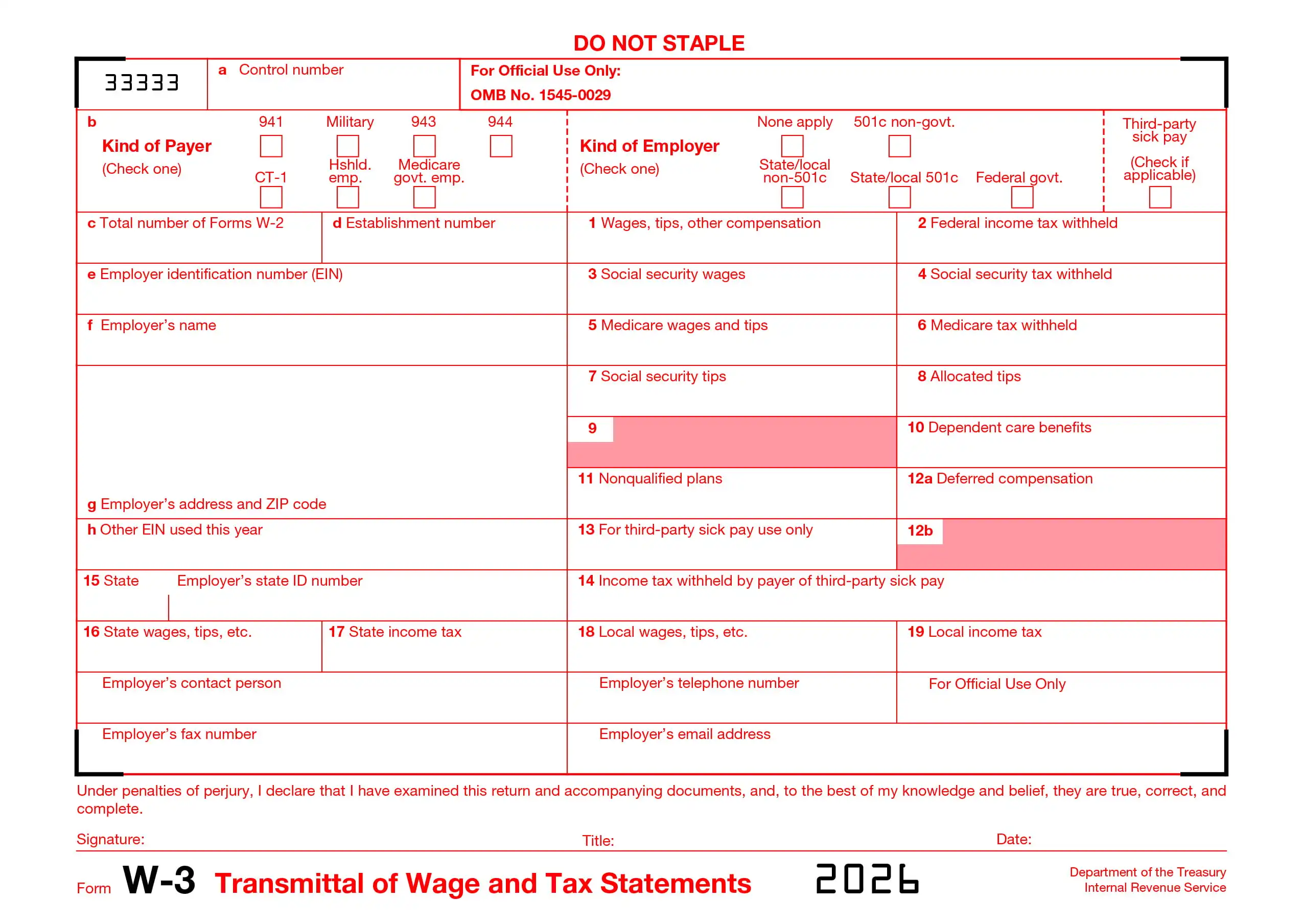

What Is W3 Form?

The benefits of filing your w3 form on time.

If you’re looking to save some money on your taxes this year, the best place to start is by filing your printable w3 form on time.

Filing your printable w3 form with your employer isn’t required, but it can provide you with several benefits if you choose to do so.

Here are some of the most important benefits of filing your printable w3 form on time this year.

Avoid losing future refunds

Any return is initially used to pay any back taxes owing, in part or whole. If you file late, you run the risk of losing a future refund.

If you owe back taxes and are unable to pay them in full when you file, then part or all of any refund is first used to pay these taxes.

In other words, if it appears that you will be getting a $1,000 refund but owe $500 in back taxes, then only $500 will go toward your tax bill, and the remaining $500 can be applied as a credit toward future tax payments.

Safeguard credit

If the IRS issues a tax lien against a person, it may negatively impact credit ratings and make it more difficult to get credit.

If you’re afraid that you might owe taxes or are worried about protecting your credit scores, it’s a good idea to file your return early.

For example, if a taxpayer files his return before April 18th and has already been assessed by April 15th, he can print out a prior-year tax receipt from IRS.gov and file W3 form pdf 1040X—Amended U.S.