Summary: The $25,000 tip deduction allows eligible tipped employees to reduce taxable income, but it can create challenges when proving income for loans. Lenders rely on properly formatted paystubs to verify earnings, and incorrectly reported tips may lead to delays or rejections. This guide explains how tax-free tips work, how to show them correctly on a paystub, and how lenders evaluate tip-based income. Using an accurate and compliant paystub generator helps ensure tip income is clearly presented and accepted during the loan approval process.

The $25,000 tip deduction has created new opportunities for tipped employees to reduce taxable income, but it has also raised an important question: how to show tax-free income on paystub with tips when applying for a loan? Many lenders rely on paystubs, not just tax returns, to verify income, and incorrectly formatted tip earnings can lead to loan delays or outright rejections.

In this guide, we explain how the $25,000 tip deduction works, how to show tax-free income on paystub, and how to deduct tips from paycheck. Once you understand these details, you can structure deductions according to your needs, preview your earnings and deductions using a pay stub template, and then create an accurate paystub with a reliable paystub creator.

A compliant paystub can help present your income clearly and credibly during the loan process.

What is the $25,000 Tip Deduction?

Under the $25,000 tip credit, qualified tipped workers may subtract certain reported tips from their earned income until they reach an annual cap of $25,000.

This deduction is designed to provide tax relief to employees who earn a significant part of their income through tips, such as restaurant staff, hospitality workers, and service professionals.

Even if tips are income, this rule reduces the amount of federal income tax that is owed when documentation and reporting of tips are done correctly. But how this tip adjustment on a paystub is shown is key, especially when that paystub serves as proof of loans or mortgages.

Defining the Tax-Free Tip Rule for 2026

For 2026, the tax-free tip rule allows qualifying tip income to be treated differently from regular wages for federal tax purposes. Under this rule, certain reported tips may be excluded from taxable income calculations, up to the $25,000 limit, provided they meet IRS reporting requirements.

It’s important to understand that “tax-free” does not mean “unreported.” Tips must still be accurately recorded, disclosed, and reflected in payroll records. On a paystub, this often means tips are shown separately from hourly wages and clearly identified so lenders and tax authorities can distinguish taxable earnings from eligible tip deductions.

Who Qualifies for the $25,000 Tip Deduction?

The $25,000 tip deduction generally applies to employees who earn tips as a regular part of their job and report those tips through proper payroll or employer systems. Common qualifying roles include:

- Restaurant servers and bartenders

- Hotel and hospitality staff

- Delivery drivers

- Salon and personal care professionals

- Other service-based employees who receive tips directly from customers

To qualify, tips must be consistently reported, and the individual must meet federal income and employment criteria. Independent contractors may be subject to different rules, which is why accurate classification on paystubs and tax records matters.

Reported Tips vs Unreported Cash Tips

One of the biggest challenges with tip adjustment on paystub is the difference between reported tips and unreported cash tips.

- Reported tips on paystub are disclosed to the employer and included in payroll records. These tips can appear on a paystub and be considered during loan verification.

- Unreported cash tips are not documented and do not appear on paystubs or tax filings, making them unusable for loan applications and potentially risky from a compliance standpoint.

For loan purposes, lenders typically only recognize reported tip income that appears on official paystubs and aligns with bank deposits and tax records. This is why using a compliant paystub generator and maintaining accurate reporting is essential when claiming the $25,000 tip deduction.

Why Banks Reject Tip-Based Loan Applications

Banks and lenders are cautious when reviewing loan applications that rely heavily on proof of income for loan with tips. While tips are a legitimate source of earnings, they can be difficult to verify if they are not reported and documented correctly.

Below are the most common reasons tip-based loan applications get rejected.

1. Paystubs That Don’t Match Bank Deposits

One of the first checks lenders perform is comparing paystub amounts with bank statement deposits. If the net pay shown on a paystub does not align with actual deposits, it raises red flags.

Mismatches can suggest verifiable income for loan, incomplete records, or potential misrepresentation. For tipped employees, this often happens when tips are shown on a paystub but not deposited through payroll, or when deposits vary without explanation.

2. Income Inconsistency Concerns

The lender verification of paystub income is important while approving loans. Tip income often fluctuates from pay period to pay period, which can make it appear unreliable. If the tip adjustment on the paystub shows large variations in earnings without a clear pattern, underwriters may view the income as unstable and exclude it from qualification calculations.

3. Cash Tips Without Documentation

Cash tips that are not reported to an employer or included in payroll records cannot be verified by lenders. Even if the income is real, banks usually will not accept cash tips unless they are properly documented and reflected on pay stubs.

Without formal records, lenders have no way to confirm the source, frequency, or legality of the income. As a result, unreported cash tips are often excluded entirely from loan eligibility reviews.

4. Missing or Unclear Employer Verification

Banks also need to verify the employer listed on the paystub. If employer details are missing, incomplete, or unclear, the paystub may be considered unreliable.

Loan officers typically look for:

- Employer name and address

- Pay period and pay date

- Employee name and identification

- Clear breakdown of wages and tips

Paystubs that lack this information or appear informal are more likely to be rejected during underwriting.

Also Read: How to Calculate Tax-Free Overtime on Your 2026 Paystubs?

How Lenders Evaluate Tip Income for Loans

When reviewing loan applications that include tip income, lenders focus on verification, consistency, and documentation rather than on how much the applicant earns in a single pay period. Underwriters rely heavily on pay stubs to determine whether tip income can be counted toward loan qualification.

What Underwriters Look for in Paystubs

Underwriters examine pay stubs to confirm the tip adjustment on paystub is legitimate and properly reported. A lender-ready paystub should clearly display:

- Employee and employer information

- Pay period and pay date

- Breakdown of hourly wages and tip income

- Tax withholdings and deductions

- Net pay that aligns with deposits

If tips are combined with wages or not clearly identified, underwriters may exclude that income entirely.

Required Pay History (30–90 Days)

Most lenders require 30 to 90 days of recent paystub for personal loan to evaluate tip-based income. In some cases, especially for mortgages, lenders may request a longer history.

Providing multiple pay stubs helps underwriters:

- Identify income patterns

- Verify consistency

- Confirm ongoing employment

- Reduce the risk of misrepresentation

A single paystub is rarely sufficient for tip income verification.

Role of Clean Formatting and Accuracy

Clear and professional formatting plays a major role in whether a paystub is accepted. Lenders prefer pay stubs that are easy to read and follow standard payroll layouts.

- Errors, missing fields, or unclear labelling can delay underwriting or lead to rejection.

- Accurate calculations, proper income classification, and consistent formatting help lenders quickly verify paystub with tips included and move the loan application forward.

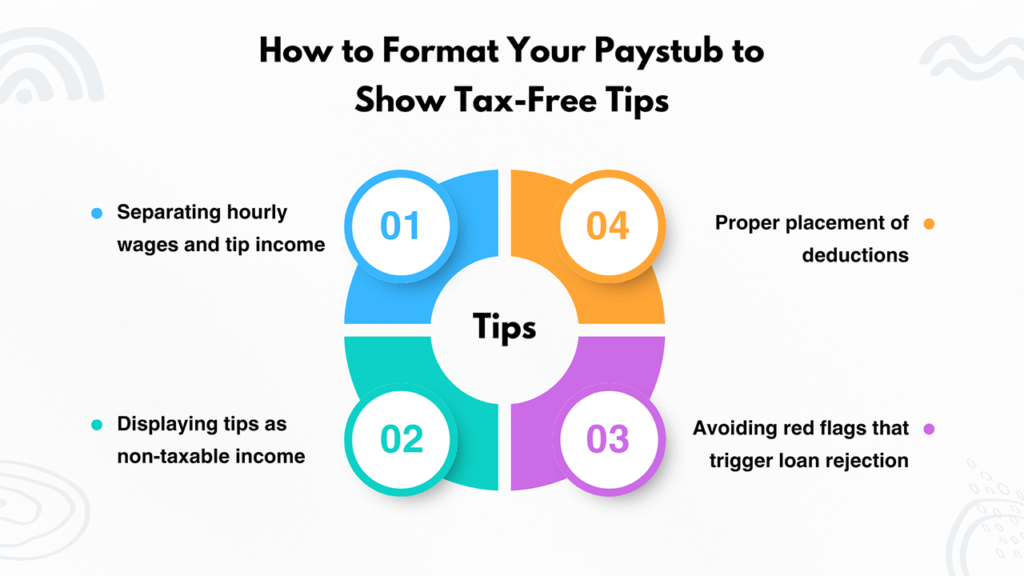

How to Format Your Paystub to Show Tax-Free Tips

Formatting cash tips on paystub with tax-free tips requires clarity and proper structure to ensure smooth verification. Earnings and tips should be shown separately, non-taxable tips must be clearly labeled, and deductions should be applied only to taxable income.

A well-organized pay stub helps avoid confusion and reduces the risk of rejection during income or loan verification.

- Separating hourly wages and tip income: List wages and tips on separate earning lines for a clear income breakdown.

- Displaying tips as non-taxable income: Clearly mark tax-free tips to show they are excluded from tax calculations.

- Proper placement of deductions: Apply deductions only to taxable wages, not to tax-free tips.

- Avoiding red flags that trigger loan rejection: Use accurate figures and consistent formatting to ensure easy verification.

Also Read: OBBB Act 2026 Explained

Essential Documentation for Your Loan Officer

When applying for a loan, providing accurate proof of income for loan with tips helps speed up the approval process. Along with a properly formatted pay stub, lenders often request additional records to verify income stability and employment history. Having these documents ready improves transparency and reduces delays.

- Required paystub: Recent paycheck stubs showing earnings, deductions, and net pay are used to verify your current income.

- Bank statements: Statements help confirm regular income deposits and overall financial consistency.

- W-2s or 1099s: These tax forms validate annual income for employees and independent contractors.

- Tip reports or employer records: These important documents support reported tip income and help lenders verify additional earnings.

Tips for Passing Mortgage Underwriting with Tax-Free Income

Mortgage providers review tax-free and tip-based income carefully to ensure it is stable and reliable with employer tip deduction rules. Proper documentation, consistent reporting, and clear pay stub formatting can significantly improve your chances of approval.

Tip 1: Maintaining consistent reporting

Report tax-free income the same way on every pay stub, bank statement, and employer record. Inconsistent labels or changing amounts can raise concerns about income reliability. Consistency helps underwriters trust your reported earnings.

Tip 2: Using multiple pay periods

Providing pay stubs from several pay periods shows steady income over time. Lenders prefer patterns rather than one-time earnings. Multiple records help confirm that your income is ongoing and dependable.

Tip 3: Avoiding sudden income spikes

Unexplained jumps in income may appear risky to underwriters. If income increases, it should be supported by employer documentation or a clear explanation. Stable income trends are more likely to be approved.

Tip 4: Aligning paystubs with tax filings

Pay stub figures should closely match the income reported on tax returns and W-2s or 1099s. Differences between documents can delay approval or trigger additional verification. Alignment ensures accuracy and credibility.

Tip 5: The 2-Year Consistency Rule for tipped employees

Many lenders look for at least two years of consistent tip income before counting it toward qualification. This helps confirm long-term earning stability. Tip records and employer statements strengthen your application.

Common Pitfalls When Claiming the $25,000 Deduction

When claiming the $25,000 deduction, accuracy and consistency are critical. Mistakes in reporting tip income or formatting pay stubs can lead to delays, rejections, or compliance issues.

Avoiding these common pitfalls helps ensure your documentation remains clear, reliable, and acceptable for verification.

1. Overstating tip income

Reporting higher tip income than actually earned can raise red flags during audits or reviews. Tip amounts should always match employer records and bank deposits. Accuracy builds credibility with lenders and tax authorities.

2. Mixing personal cash tips with payroll tips

Personal cash tips should be tracked separately from payroll-reported tips. Combining them can create discrepancies between pay stubs and tax filings. Clear separation ensures transparency and proper reporting.

3. Using inconsistent pay periods

Pay stubs should follow a consistent pay schedule, such as weekly or biweekly. Irregular pay periods can make income appear unstable. Consistency helps reviewers understand your earnings pattern.

4. Creating inaccurate or misleading paystubs

Incorrect figures, missing details, or altered layouts can cause immediate rejection. Pay stubs must accurately reflect earnings, deductions, and net pay. Professional formatting improves trust and verification success.

Key Takeaways

Using a properly formatted and compliant pay stub is essential when reporting tax-free or tip-based income. Income should always be reported consistently across pay stubs, bank statements, and tax documents to avoid discrepancies.

Common mistakes such as overstating income, mixing personal and payroll tips, or using inconsistent pay periods can lead to verification issues. StubCreator provides professional pay stub templates that help ensure accurate records and smoother approval for loans, taxes, and other official purposes.

FAQs:

1. What is non-tax income on my paystub?

Income not subject to federal income tax, such as qualified tax-free tips or certain reimbursements, is shown separately from taxable wages.

2. How to go tax-exempt on your paycheck?

You have to meet the IRS qualifying rules and have a valid W-4 that claims you are exempt from federal tax withholding.

3. What if my taxable income is zero?

No federal income tax is withheld, but Social Security and Medicare taxes may still apply.

4. How to make sure no taxes are taken out of a paycheck?

You legally have to qualify for exemption, and you must fill out the W-4 correctly or they will continue to withhold taxes.

5. What is the tip offset on a paystub?

A tip credit for already-received tips that brings down employer-paid wages to minimum wage.

6. What does “tips paid” mean on a paystub?

The total amount of tip income reported and paid to the employee for the pay period.

Related Blogs:

How Long Is a Business Day: Definition, Meaning And More

How Many Hours is Part-Time? A Guide For Employers And Employees

FAQ's

Should tips be deducted from a paycheck?

+

Tips are not reduced from earnings; taxes may be withheld from reported tips.

How are tips reported on a paycheck?

+

Tips may come in as their own line of earnings and are part of gross income.

Should tips be deducted from a paycheck?

+

Tips are not subtracted from wages, but they can lower take-home pay because of tax withholding.

When did tip income become taxable?

+

Under U.S. law, tip income has been taxable since 1917.

Are my tips taxed on my paycheck?

+

Yes, reported tips are usually covered by federal income and payroll taxes unless they fall under a specific exemption.