Independent Contractor Pay Stubs for 1099 Workers

As a 1099 worker, you usually don’t receive regular payroll pay stubs. This can make it hard to show your income when applying for an apartment, a loan, or other financial needs. Our compliant paystub generator tool helps to create a paycheck statement that shows your earnings, non-employee compensation, and year-to-date income in a professional format.

Why 1099 Professionals Trust StubCreator for Proof Of Income?

1st Pay Stub Free

Definite Calculations

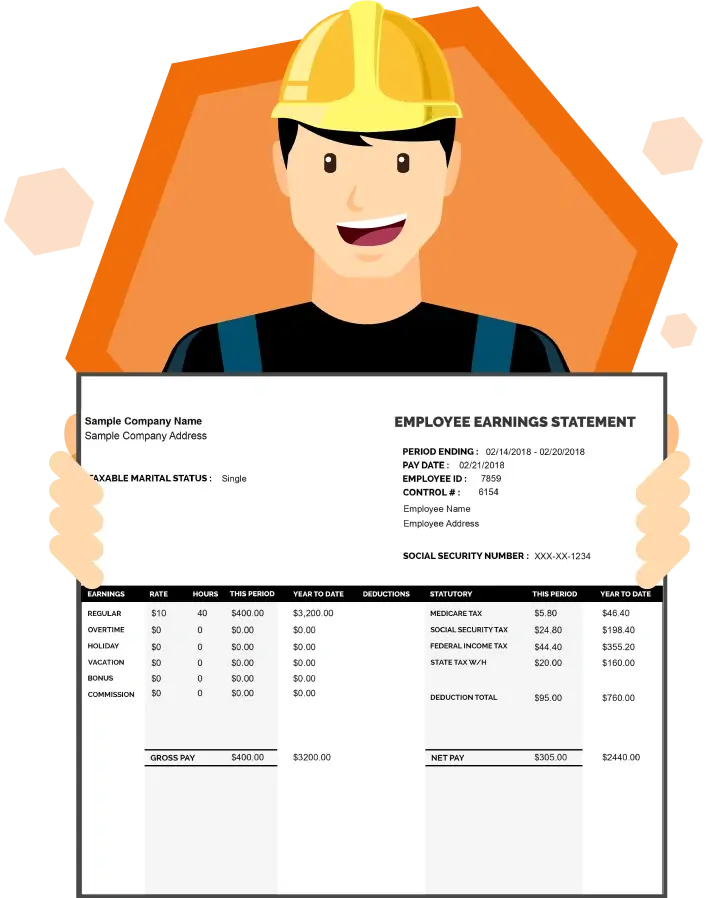

Free Independent Contractor Pay Stub Template

Advanced Stub Maker

Free Corrections & Download

Around-the-Clock Service

How to Generate a Pay Stub for 1099 Independent Contractors?

You just need to follow the steps mentioned below to generate your 1099 Independent Contractors’ paystub.

- Enter the payer details, including the client name and their business address.

- Type in your contractor information, like your legal name, address, and Tax ID.

- Pick an independent contractor pay stub template that fits your needs.

- Enter your income details, such as the pay period and payday, and your total contract earnings and deductions.

- Include YTD - Year to Date totals for consistent income verification.

- View your Independent Contractor pay stub details to check all information for accuracy.

- Download or email your professional independent contractor check stub instantly.

Generate Professional 1099 Independent Contractor Pay Stubs Online

Secure your independent contractor proof of income with StubCreator!

FAQs

How much does an independent contractor pay in taxes?

+

The independent contractor needs to pay the 15.3% rate, which is a combination of ( Social Security 12.4% and Medicare 2.9% ).

How do independent contractors pay taxes?

+

Independent contractors have to pay various types of taxes, including income, self-employment and perhaps state taxes. They must file an annual tax return using Form 1040 with the C Schedule for income and expenses, as well as a Schedule SE for self-employment.

Can independent contractors make their pay stubs?

+

Yes, for sure, Independent contractors can create their pay stubs. In order to provide their proof of income, or they require an official record of earnings or simply have to submit somewhere like a bank, then using the independent contractor pay stub generator.

Do independent contractors receive pay stubs?

+

From the company, they can’t get the paystubs, but they can create a paystub by using the third pary tools like StubCreator.

Why would a contractor need a pay stub?

+

Here’s why an independent contractor might need a pay stub: Keeping financial records and tracking how much money comes in as income, reporting to their own taxes, Legal or court documentation, and Proof of income for rental purposes.

Is it legal for independent contractors to generate their pay stubs?

+

Yes, it is legal for independent contractors to create the paystub. The independent contractors are not employees, and employers do not provide any paychecks or stubs; they can generate their own pay stubs by using third-party tools.

How often should I create pay stubs as an independent contractor?

+

There is no clear schedule for independent contractors who need to generate a pay stub. Because it is not required. But they can generate based on the situation.

What’s the best pay stub generator for 1099 contractors?

+

Stubcreator is the best tool to generate the paystub for contractors. This platform offers a first stub free with extensive features such as accurate tax calculations, a variety of templates, and direct download and send via email.

Is a 1099 form the same as a pay stub?

+

No, a 1099 form is different from a paystub. These two documents serve different purposes and are used at various times while working as an independent contractor.