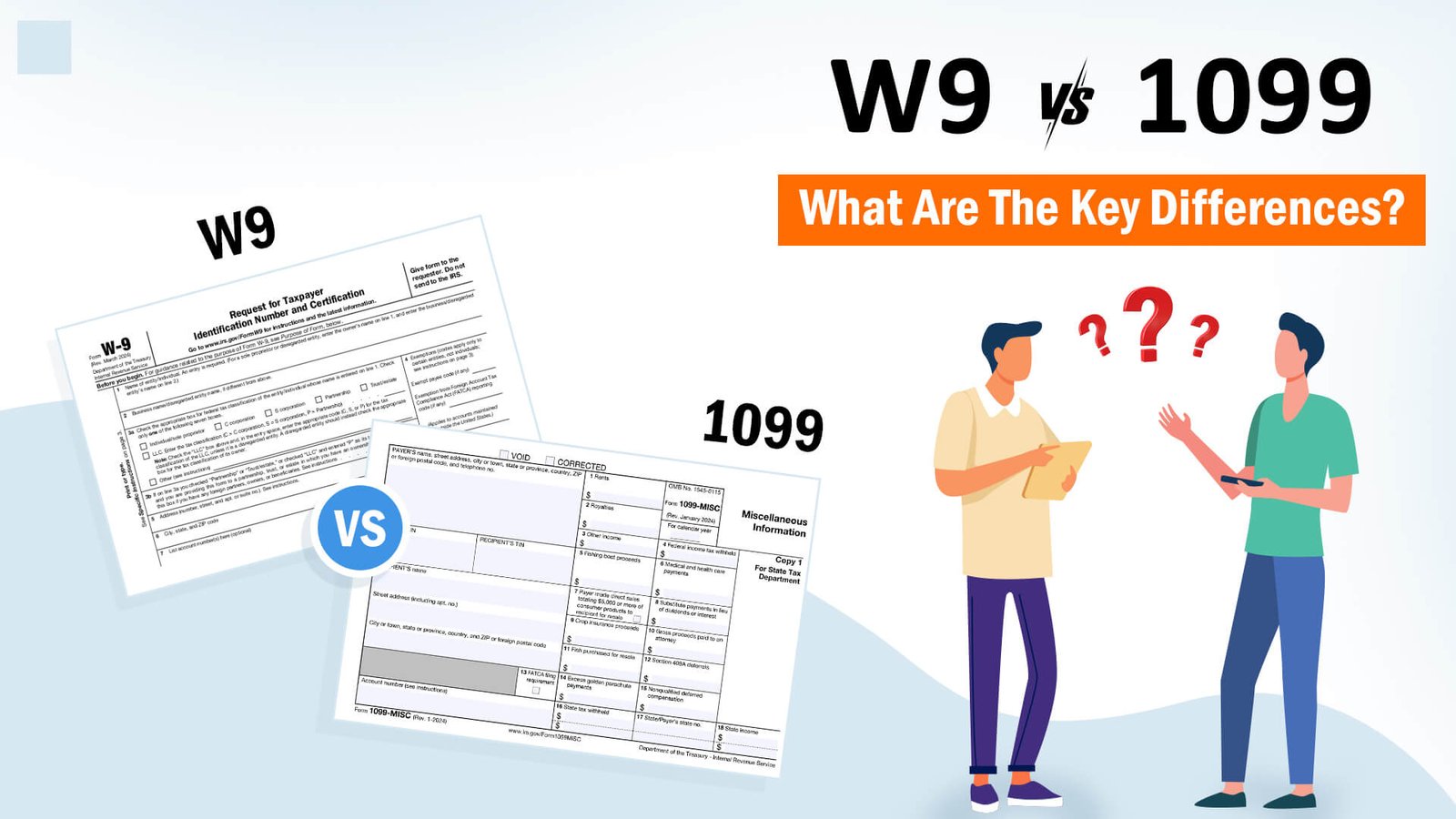

Managing taxes becomes slightly more complex if you want to expand your business or start working with independent contractors. Many small business owners presume that hiring non-employees reduces the paperwork burden, but the truth is that there is still required reporting to the IRS when paying contractors. This requires an understanding of what tax reporting form to use when processing these payments.

Up until 2020, payments made to contractors were reported to the IRS using Form 1099-MISC. Later, however, the IRS introduced Form 1099-NEC specifically for reporting nonemployee compensation payments and has left many small business owners confused as to when and how they should report these payments with it. We will explore both forms here, along with their purpose, as well as additional information that might help.

What Is a 1099 NEC Form?

1099 NEC form, or Nonemployee Compensation Form, is an information return used by the Internal Revenue Service (IRS) to report all payments of $600 or more made during a calendar year to nonemployees who were not employees.

Payments such as these typically go to independent contractors, freelancers, and other self-employed professionals not considered employees by a company.

Typical independent contractors who would receive a Form 1099-NEC are:

- Freelancers who provide writing, design, marketing, or other specific services.

- Self-employed individuals or sole proprietorships that provide services related to business or trade.

- Attorneys and tax professionals who individually perform services.

- Real estate agents who receive a commission, but are not classified as employees under the Form 1099 NEC.

Generally, business entities do not receive miscellaneous 1099; however, there are specific exceptions for payment of attorneys’ fees in Box 1 of Form 1099-NEC and gross proceeds paid to attorneys reported on Box 10 of Form 1099-MISC.

Individuals, sole proprietors, partnerships and estates who receive compensation should fill out an IRS Form 1099-NEC. Attorneys, accountants, consultants, real estate agents and other service professionals frequently receive this document.

What Is a 1099 MISC Form?

Many people confuse it with Form 1099-NEC, used for reporting contractor payments. However, the 1099 MICS form is different from the 1099 NEC form.

Form 1099-MISC is an IRS tax form assigned for a variety of nonemployee income types, not falling under regular wages or salaries. Form 1099-MISC serves a different purpose and covers all other types of earnings, like rents, royalties, and prizes.

Any business or person that pays $600 or more in payments during one calendar year for any of the following must file a 1099 MISC form:

- Prizes and awards not linked to work.

- Rent for office, property, or equipment.

- Other income payments, such as commissions or settlements.

- Crop insurance proceeds.

- Medical and healthcare payments.

- Crop insurance proceeds.

- The fishing boat proceeds.

- Payments to attorneys for legal services.

- Cash payments for buying fish or other aquatic life from anyone.

- Cash paid from a notional principal contract to an individual, partnership, or estate.

There are a few exceptions to the $600 threshold for the 1099NEC fillable form :

- At least $10 or more in royalty payments must be reported.

- Direct sales of $5,000 or more in consumer products to a buyer for resale also must be reported.

- Taxes withheld under the IRS backup withholding rule must be reported, without regard to the amount of the payment.

Form 1099-MISC assists businesses in accurately reporting miscellaneous income that does not qualify as employee wages or contractor payments and ensures transparency in compliance with IRS regulations.

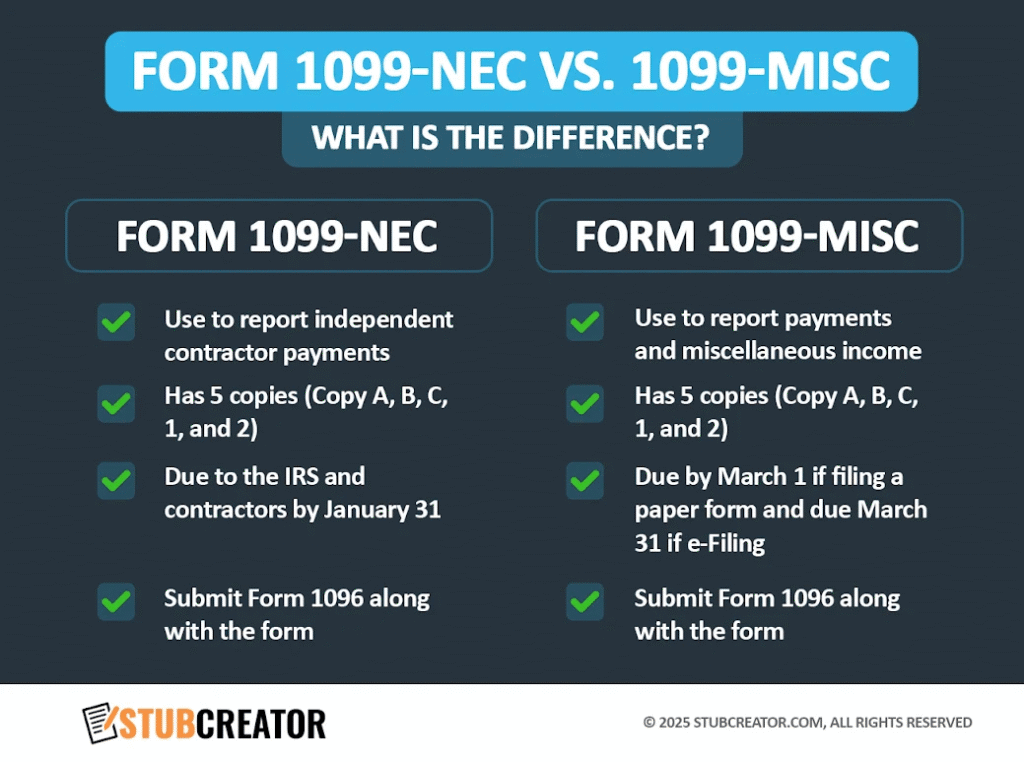

1099 NEC Vs 1099 MISC: What Is The Difference?

Most people don’t know the differences between Form 1099-NEC and 1099 MISC forms. Although both forms report different business payments, each has its own purpose and applies to different types of income. Using the correct form helps you stay compliant with IRS regulations and avoid penalties.

| Category | Form 1099-NEC | Form 1099-MISC |

| Purpose | Reports payments for nonemployee compensation, such as payments made to freelancers, independent contractors, and similar individuals for services performed. | Used for reporting miscellaneous types of income that don’t fall under nonemployee compensation, such as rent, prizes, medical payments, and royalties. |

| Who Files and Who Receives It | Filed by any business that pays an independent contractor or a self-employed professional to do work or perform services.

The form is sent to both the contractor and the IRS. |

Filed by a business for other miscellaneous payments, including rent, healthcare payments, crop insurance proceeds, and attorney fees.

This form is typically sent to property owners, prize winners, or service providers who received those payments. |

| Filing Thresholds | 1099 NEC filing requirements are that, in the course of your business, you’ve paid $600 or more in nonemployee compensation for the year. | The threshold amount for Form 1099-MISC is $600 or more for most payments, but is only $10 or more for royalties or broker payments instead of dividends or tax-exempt interest. |

| Filing Deadlines | Whether filing electronically or by mail, the due date for filing Form 1099-NEC is January 31. | 1099 MISC online filing, or by mail, deadline is March 31 if filing electronically or February 28 by mail. |

How To File 1099 NEC & 1099 MISC Forms For a Contractor?

Take care when filing manual 1099 NEC and MISC forms each tax year to ensure they are filed on time. Make sure you understand the difference between 1099 NEC and 1099 MISC before filling them in correctly.

Here’s how you can correctly fill out both forms.

How to Fill Out 1099 NEC Form

- Step 1: Provide your Federal Employer Identification Number (FEIN), Company Name and Address in the appropriate boxes on the form.

- Step 2: Enter information for an independent contractor, including their Social Security Number or Taxpayer Identification Number, as well as their current mailing address.

- Step 3: Enter into Box 1 the total amount paid to contractors during the tax year.

- Step 4: Usually, this step should remain empty, as it only applies if a contractor is subject to backup withholding. In such cases, any applicable withheld amounts would go here; businesses typically receive notification if this box needs to be completed for any individual.

- Step 5: Fill in boxes 5, 6, and 7 with state tax information about the contractor’s income and any withheld state taxes; also specify which state the report should go to; if payments need to be reported in multiple states, print separate forms for each.

- Step 6: For electronic filings, submit the 1099 NEC form through the IRS e-file system. For paper filings, include it along with Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) to send it back.

How to Fill Out Form 1099-MISC

- Step 1: Complete each field by providing your FEIN, business name and address.

- Step 2: Enter all relevant contractor or payee information, including SSN/TIN and mailing address.

- Step 3: For your business’s convenience, Boxes 1 through 18 allow you to report any payments made throughout the year that did not fit within any other box. Make sure all applicable boxes are completed.

- Step 4: For electronically filing forms 1099-MISC, submit them via the IRS e-file system; for paper filing, send your paper forms along with Form 1096 directly to the IRS.

Conclusion

Form 1099-NEC is for nonemployee compensation, while Form 1099-MISC covers miscellaneous payments such as rent, royalties or prizes- the blog is a total guide for the 1099 forms.

This Pay stub generator free can assist with the filing process by offering access to accurate and compliant Form 1099-NEC and Form 1099-MISC templates, along with an editable free pay stub template that makes creating professional-looking paystubs that comply with tax law simple. Upload either form directly to the IRS for quick submission!

Let Stub Creator help keep paystub organized to appear accurate and compliant with just a click!

Curious Minds Also Ask

What if I accidentally filed a 1099-MISC instead of a 1099-NEC?

If you filed a 1099-MISC for payments that require a 1099-NEC, file a corrected return showing zeros on the 1099-MISC. Then, provide a new 1099-NEC with accurate information to the payee.

How do I know if I should file a 1099-MISC or 1099-NEC?

Use Form 1099-NEC to report nonemployee compensation and Form 1099-MISC for miscellaneous income, such as rent or royalties.

Does 1099-NEC count as 1099-MISC?

No, Form 1099-NEC is separate from Form 1099-MISC and reports nonemployee compensation only.

Do contractors get a 1099-MISC or NEC?

Freelancers and contractors receive Form 1099-NEC if paid $600 or more for services.

Do lawyers get 1099-MISC or NEC?

Lawyers receive a Form 1099-NEC for services and a Form 1099-MISC for settlements or other payments.

When did 1099-NEC replace 1099-MISC?

Beginning with the 2020 tax year, Form 1099-NEC replaced 1099-MISC for reporting nonemployee compensation.

How much tax will I pay on a 1099-NEC?

You must pay self-employment tax of 15.3 percent plus income tax on total earnings.

Who should not receive a 1099-MISC?

Companies usually never receive a 1099-MISC except when paid for legal or medical services.

Does an LLC get a 1099-MISC or 1099-NEC?

Single-member or partnership LLCs receive a 1099-NEC. Most corporations do not.

What payments are excluded from a 1099-NEC and 1099-MISC?

Excluded are payments to corporations, employees (via W-2), and personal transactions.

What happens if I get a 1099-NEC but don’t have a business?

You must still report the income as self-employment earnings on your tax return.

How much money does an LLC have to make to file taxes?

An LLC would need to file taxes if the business had any income, expenses, or activity during the year.

Can I send 1099-NEC and 1099-MISC together?

Yes, you can file both 1099-NEC and 1099-MISC; however, they have to be submitted separately.

Do subcontractors get a 1099-MISC or 1099-NEC?

Subcontractors receive a 1099-NEC if paid $600 or more for services.

Who does not receive a 1099-NEC?

Corporations, and employees paid on a W-2, do not get a 1099-NEC.

FAQ's

What is the main difference between Form 1099-NEC and 1099-MISC?

+

Form 1099-NEC is used to report nonemployee compensation paid to freelancers or independent contractors, while 1099-MISC reports miscellaneous income such as rent, royalties, or prizes.

Who should receive a 1099-NEC instead of a 1099-MISC?

+

Businesses should issue a 1099-NEC to any nonemployee (like freelancers, consultants, or contractors) who earned $600 or more for services during the year.

When should you use a 1099-MISC form?

+

Use 1099-MISC for payments not related to services, such as rent, legal settlements, royalties, or awards. It’s also used for certain types of other income that don’t fit under 1099-NEC.

Are the filing deadlines different for 1099-NEC and 1099-MISC?

+

Yes. 1099-NEC forms must be filed with the IRS and sent to recipients by January 31, while 1099-MISC forms are generally due by February 28 (paper) or March 31 (electronic), depending on the filing method.