As per the latest payroll statistics, 34% of employees can’t easily ignore the paycheck or paystub mistakes!

No matter if you are working with full-time employees or independent contractors, proper organization of every payroll and accurate pay stubs is necessary for your financial transparency. Proper documentation of payroll makes it simple and easy to track business progress, manage costs, and be compliant with tax obligations.

Thanks to modern technology and online paystub generator tools, business owners are able to build professional and reliable pay stubs in just a few minutes.

Here, in this blog, we will discuss the most important advantages of having a paystub creator and take you through the easy steps of creating precise paystubs for your contractors and employees.

What Is a Paystub? – Why It Matters?

A paystub or paycheck stub is a formal document detailing an employee’s wages and deductions for a given pay cycle.

The function of a pay stub is to provide employers and employees with a clear picture of how salaries are computed. It indicates how much an employee has made before deductions, what was withheld for taxation and benefits, and the net take-home amount.

Easily generate a paystub instantly using a customized pay stub creator. Paystub creators are time-savers for freelancers, small business owners, or self employed individuals who need documentation of payment immediately.

A paystub creator usually includes the tax and compliance; you have to manually track money, check for calculation accuracy.

A standard pay stub will generally include the following important information:

- Gross Pay: The full amount earned before any deductions or taxes are taken out.

- Deductions: The total amount withheld for federal and state income tax, Social Security, Medicare, health insurance, and contributions to a retirement plan.

- Net Pay: The resulting take-home pay after all deductions have been withheld.

- Year-to-Date (YTD) Totals: A summary of the total of employees’ earnings and the deductions withheld from those earnings starting from the beginning of the year and through the current pay period.

Paystubs are needed for income verification, tax submission, and record-keeping of employment.

What Is Paystub Creator?

An automatic paystub creator is an automated system in which you input the necessary details, and it will generate a paystub for you.

Simply enter your basic information (employee name, employee salary/rate, hours worked, tax information, etc.) and create a paystub online by using the paystub creator tool automatically calculates employee earnings, deductions, and net income based on the information you’ve provided.

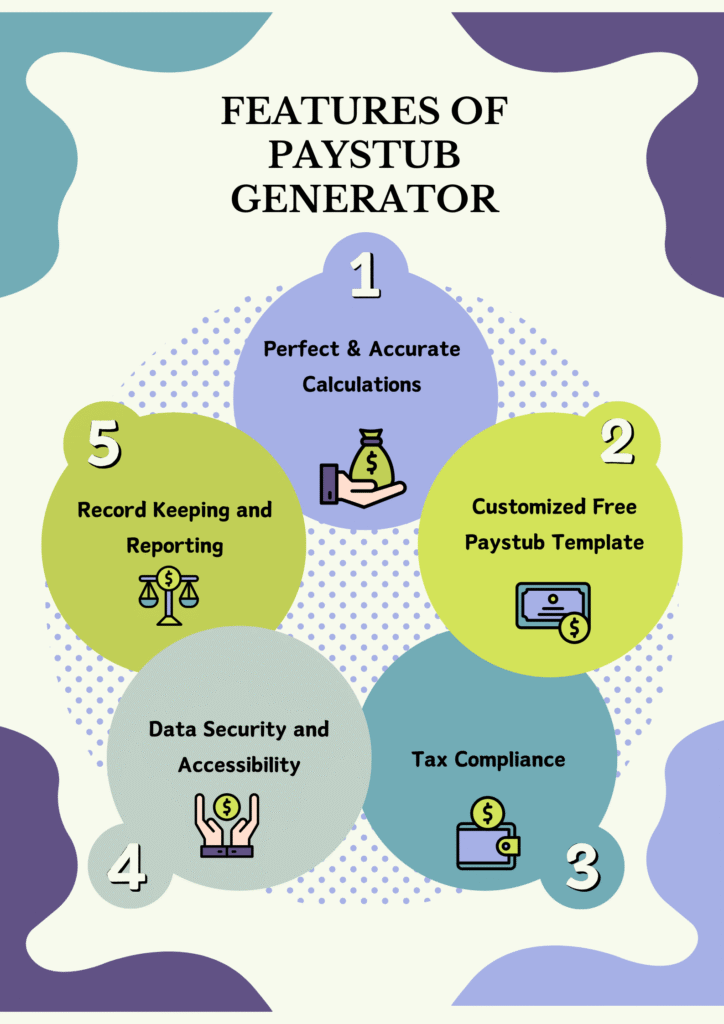

Features Of Paystub Generator

An instant paystub maker has some robust features that make it easier to manage payroll. It assists companies in saving time, remaining tax-compliant, and keeping professional records of employee payments.

Here are some of the key features that make them an indispensable asset for today’s employers.

-

Perfect & Accurate Calculations

One of the most important advantages of a paystub creator is its accuracy. It will automatically compute gross wages, taxes, deductions, and net take-home pay from what you input. This reduces the possibility of human error and guarantees workers get paid accurately every time.

-

Customized Free Paystub Template

Using a paycheck stub generator, employers can easily create pay stubs that will fit their brand by using the professional pay stub template. You can include your company logo, business address, and other customized information to ensure a consistent, professional look. Your payroll documents will have a refined appearance and will be easily identifiable because of this personalization.

-

Tax Compliance

All businesses are bound by federal, state, and local tax regulations. Custom paystub creator tools are designed to comply with these regulations through the automatic application of the proper tax rates and deductions. This tool makes errorless paystubs likely to occur and ensures employers can distribute accurate paystubs that are compliant with the law.

-

Data Security and Accessibility

Payroll data includes sensitive information; therefore, security is vital to create a paystub online. A trustworthy paystub generator like Stub Creator employs encryption and safe storage to protect employee and business information. The tool provides a platform where employers and employees can safely view, download, or print their pay stubs remotely.

-

Record Keeping and Reporting

Another useful aspect of a paycheck stub generator is that it can give a printed and emailed copy of the pay stubs. You can easily access the old pay stubs from your mail for record-keeping. Moreover, you can use the pay stubs for audits, budgeting, or financial planning. All this makes payroll history easier and more organized to handle for businesses and employees alike.

Benefits Of Using Pay Stub Maker

Paystub maker provides various benefits beyond simply printing out professional-looking pay stubs. It assists business owners with efficient management of payroll, reduces manual labor, and ensures compliance with labor regulations. Some of the key advantages of a paystub maker for your business are as follows.

-

Payroll Management Simplified

To handle payroll and then create a paystub is error-prone and time-consuming as well. A paystub creator streamlines this whole process by doing calculations automatically for wages, deductions, and taxes. You simply need to input proper employee information, and the software will automatically create a professional-looking pay stub.

Not only does this save hours of manual labor, but it also eliminates the danger of paying employees too much or too little. Simply put, a Paystub Generator makes you process payroll quicker, more precisely, and with fewer headaches.

-

Eliminates Human Errors

Manual calculations expose payroll to errors from faulty tax deductions to misplaced net pay calculations. One tiny error can cause serious problems come tax time or in employee pay disputes.

A paystub creator circumvents this possibility by automatically computing all the calculations. As long as you enter the right information, the software creates accurate pay stubs with earnings, deductions, and withholdable taxes included. The result is accuracy and consistency on every paystub.

-

Organized Payroll Records

Having the right payroll records is important for any business, particularly a small business. Keeping track of paper pay stubs manually can be cumbersome and messy, but it can be done easily with the paystub creator for small businesses.

An online paycheck stub generator keeps all the pay records safely online, where they are available anytime you need them. By using Paystub Builder Online, you can reduce administrative burdens and be able to concentrate more on efficiently managing your business.

-

Time And Effort Saving

Operating a business already takes many things on the plate, and hours of manual payroll preparation can be draining. A paystub creator does the routine work for you, saving you precious time for both accountants and employers. You can design, customize, and distribute professional pay stubs in minutes by using the professional pay stub template from Stub Creator.

-

Promotes Transparency and Professionalism

Issuing clear, precise pay stubs fosters employer-employee trust. A Custom Paystub Creator guarantees each pay stub clearly states income, taxes, and deductions, with no confusion whatsoever. Transparency boosts employee satisfaction and portrays a professional image of your company.

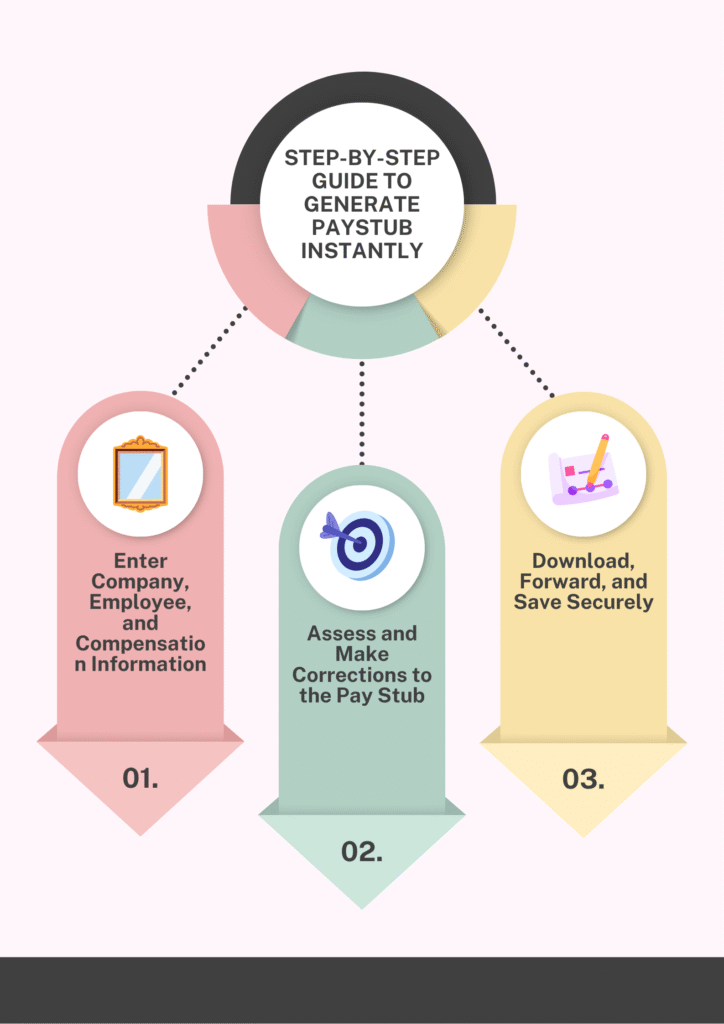

Step-by-Step Guide To Generate Paystub Instantly

Making a pay stub is a quick and simple process when you use a reliable online pay stub creator. Here is a simple, quick step-by-step guide on how to make a professional and accurate paystub in minutes.

-

Enter Company, Employee, and Compensation Information

While using the paystub generator, you need to enter your business name, address, and contact information in the first section. Enter the employee’s name, pay period and how often they get paid. Include the employee’s hourly rate or salary, hours worked, bonuses and other pay. The software will determine gross pay based on all of this information.

-

Assess and Make Corrections to the Pay Stub

Once you have entered the necessary information, preview the pay stub to verify that the details and calculations are accurate. Stub Creator enables you to customize the style of the pay stub by inserting the logo of your business, the address of your business, and comments. Make sure to double-check the deductions, taxes, and year-to-date amounts before completing it.

-

Download, Forward, and Save Securely

After you have reviewed, you can either print as a PDF or email the pay stub to your employees.

Check Stub Creator to create a paystub online!

Curious Minds Also Ask

Is Paystub Creator Legit?

Paystub creators are safe and valid applications for producing professional and accurate pay stubs. They retrieve a person’s real tax data and follow federal and state regulations. However, if you input false data, the paystub creator becomes unsafe and illegal to use.

Is It Legal To Make Your Own Paystubs?

It is perfectly legal to create the pay stubs you need, as long as you provide true and accurate data, relative to your income. Many freelancers and small business owners use paystub generators to verify their income for taxes or financial verification.

What Is The Best Free Paystub Maker?

Some of the best free paystub makers include Easy Paystub Maker, PDFPayStub, and Wix Pay Stub Generator. These pay stub makers provide you with accurate calculations, editable templates, and compatible free downloads for small businesses and individuals.

How Do Self-Employed People Get Pay Stubs?

Self-employed individuals can create their own pay stubs online by entering their company name and income details into a pay stub generator. The self-employed person can also be both the employer and the employee. They can use the generated pay stubs for either verification of income or taxes.

FAQ's

What is a paystub creator?

+

A paystub creator is an online tool that helps generate professional, detailed paystubs for employees or self-employed individuals.

Why should I use a paystub creator?

+

Using a paystub creator saves time, ensures accuracy, and provides legally compliant records for payroll and tax purposes.

Are paystub creators safe to use?

+

Yes, trusted paystub creators use secure encryption to protect sensitive financial and personal data during the generation process.

How can I create a paystub using a paystub creator?

+

Simply enter details like employee info, salary, deductions, and payment dates, then download or print your generated paystub instantly.