What is FTE? – Everything You Need To Know

Running a business requires you to make efficient use of your resources, which includes making sure your organization has the right number of employees. You can determine whether…

Posted On: Mar 02, 2026

Get Your First Paystub FREE, Worth $4.99, Every Year Per User and Per Company. Thereafter, Standard Pricing Applies Per Stub.

Tax Accuracy

Our pay stub calculations follow the 2026 IRS tax tables, including IRS Publication 15-T, FICA limits, and the 50 states of the USA tax rules to ensure accurate withholdings.

Data Privacy

Your payroll data is protected with 256-bit SSL encryption and secure systems. We do not sell, share, or disclose your personal or business information.

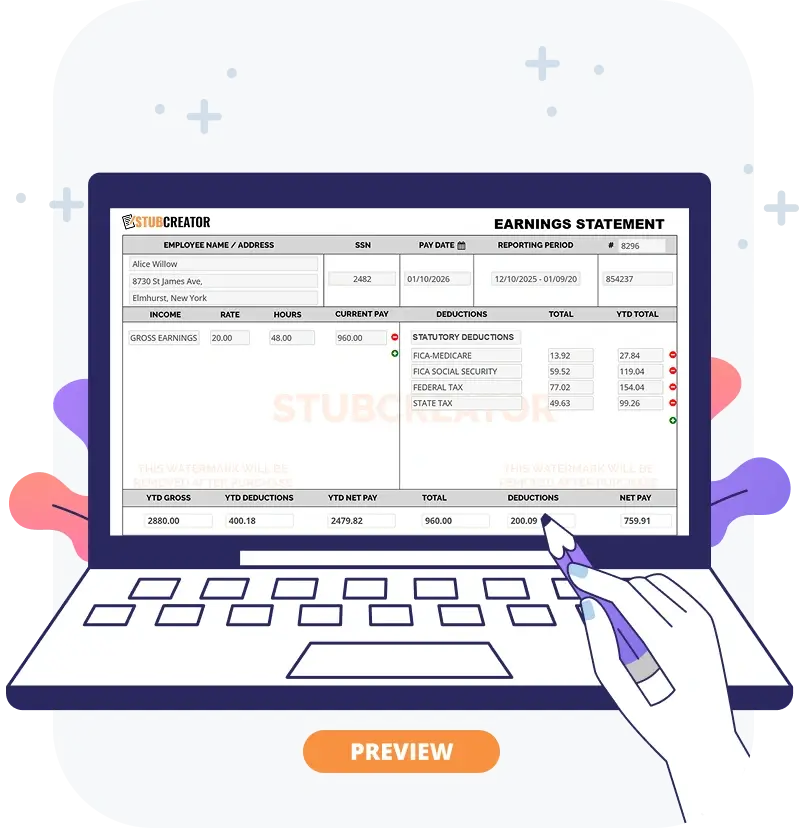

Instant Preview

In this check stub maker, you can preview your complete pay stub before downloading a high-quality PDF. The final document reflects exactly what you see during the preview step.

Expert Review

Payroll formulas are verified by expert accountants and aligned with standard accounting practices to support accurate pay stubs for employees, freelancers, W-2, and 1099 workers.

1st Paystub Free Every Year

Get your first paystub worth $4.99 totally free while using StubCreator online. You don't need any subscription or dedicated payroll software to generate free pay stubs.

Templates & Customization

Choose from multiple comprehensive pay stub template options to give your business a credible source. You can easily add company logo, custom earnings (like bonuses or tips), and deductions to match your specific needs.

The paycheck stubs, or pay stub is an earnings statement that outlines an employee’s earnings and deductions summary for a specific pay period.

Generating pay stubs is essential for businesses and independent contractors, as they serve as official proof of income, tax deductions, and employment records. Our free paystub creator simplifies the time-consuming and costly process by delivering quick and reliable results.

With a Paycheck stub generator, all it takes is a few minutes to generate pay stubs online for free.

You can check and select these optional add-on features to customize your pay stub further.

If you’re a small business owner or a freelancer, having access to professional pay stubs is vital for tax filing, loan applications, and financial transparency. A paystub is needed for filing taxes and loans. The following entities need a pay stub generator:

Employees uses paystubs for several reasons. A paystub shows how much you earned and what was deducted from your pay. It is used as proof of income when applying for a loan, renting a home, or tax filing, A free paystub maker can help you create a paystub to calculate your income and tax details.

Paystubs show when employees were paid and how much they received. Paystubs are also useful to track employees’ income & deductions. A paystub creator helps employers generate accurate paystubs quickly and keep payroll records organized.

Freelancers and entrepreneurs do not have steady incomes. So, they can create instant proof of income by using pay stubs maker. For entrepreneurs who are paying themselves, accurate payment stubs serve as valid documentation.

Accountants used to work with businesses that do not have a payroll system. You can utilize a free paystub maker, which will help to make detailed records to verify all incomes and deductions.

Ride-share drivers, delivery drivers, and other gig workers who work on an hourly basis or work part-time often do not receive formal pay stubs from their workplaces; that’s where a pay stub creator helps to get proof of income for renting.

Small businesses keep a record of all their employees’ pay with minimal effort by using a free Paystub generator. It is designed to assist owners in keeping clean records and producing a professionally looking pay stub meeting all requirements.

For medium-sized organizations, monitoring employees’ pay stub details using Excel sheets is a challenging task. A free pay check stub generator smoothens the process that ensures bulk payroll accuracy.

Self-employed people need to generate pay stubs for applying for a loan, renting any property, or documenting their income, expenses, and deductions. The pay stubs are especially designed to add key information required to show proof of income.

Payroll deductions are amounts taken from your employees’ paychecks before they receive the final amount as net pay. These payroll deductions apply to certain expenses such as taxes, benefit schemes, and savings initiatives like retirement contributions.

Employers have to make sure that the calculations and deductions of the taxes are accurate. To adjust tax calculations, you can use the Custom Paystub Generator. Common payroll deduction examples include:

The FIT taxes applied over wages, bonuses, and tips, which the entire US workforce needs to pay unless they fall in a lower income slab that is exempted. These taxes are computed using IRS guidelines for the purpose of accurate withholdings.

State and local taxes like CASDI in California, PFL in New York, and state income tax are also based on the location of the employee, not the employer. Our Paycheck stub maker will apply accurate 2026 rates to all 50 states in the United States.

Employees are required to withhold a portion for Social Security and Medicare from every paycheck. Employees may also choose to contribute to health savings accounts or flexible spending accounts.

These could be standard or Roth 401(k) plans and USA pension contributions. Both employers and employees can even pitch in, to ensure long-term financial security and retirement health.

If applicable, dues are deducted for employees covered by a union agreement. Such dues help finance various union activities and collective bargaining on behalf of all covered members, including their program of training.

Note: Our tool is updated for the 2026 tax year, including the new inflation-adjusted Federal income tax brackets and the updated Social Security wage base of $176,100.

Create pay stubs in simple steps. Get the first pay stub for FREE.

Pay only from the second pay stub onwards!

Is it legal to use a pay stub generator?

+

Yes, a check stub generator is legal as long as the information provided is 100% accurate and used for legal documentation purposes.

Can I create my own pay stub?

+

Yes, you can generate your own pay stubs whether you are an employee, self-employed, a freelancer or a contractor. However, you need to take care, all wage, deduction and tax info needs to be accurate and understandable!

How are fake pay stubs detected?

+

The fake stubs are identified by improper tax calculations, absence of details or information not match up.

Is pay stub generator legit?

+

Yes, professional tools like StubCreator are legitimate software solutions for documenting wages, provided the user enters truthful data.

How to generate a pay stub for free?

+

To generate secure pay stubs for free, simply enter your company details and wage details into our free paystub maker, preview the document and download your first stub at no cost.

What's the ideal free paystub generator?

+

The ideal paystub maker tool is one that is updated for the 2026 IRS 15-T tables, offers 100% secure SSL encryption, and provides a professional PDF format for W-2 and 1099 workers.

Can I use this payroll tool for Canadian employees?

+

No, this specific tool is calibrated for US tax laws. For Canadian payroll, you must use our dedicated Canada Paystub Generator. It is specifically designed to handle CRA requirements, provincial tax rules, CPP, and EI calculations accurately.