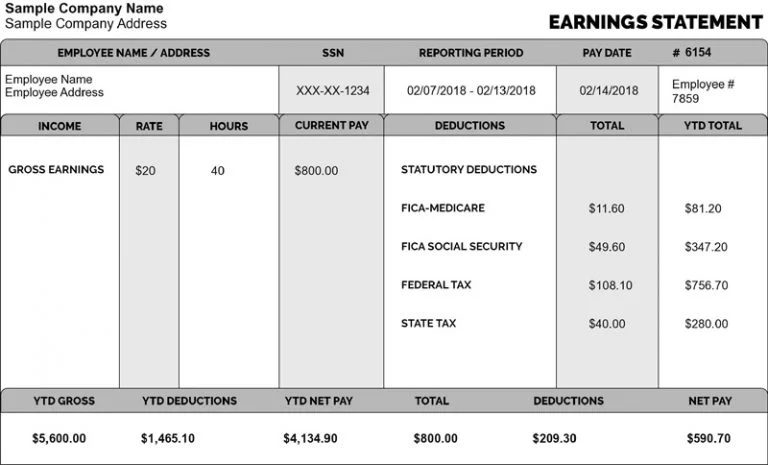

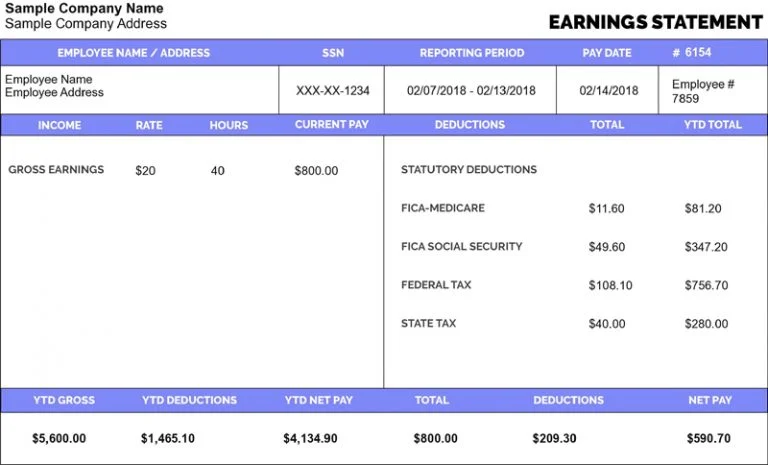

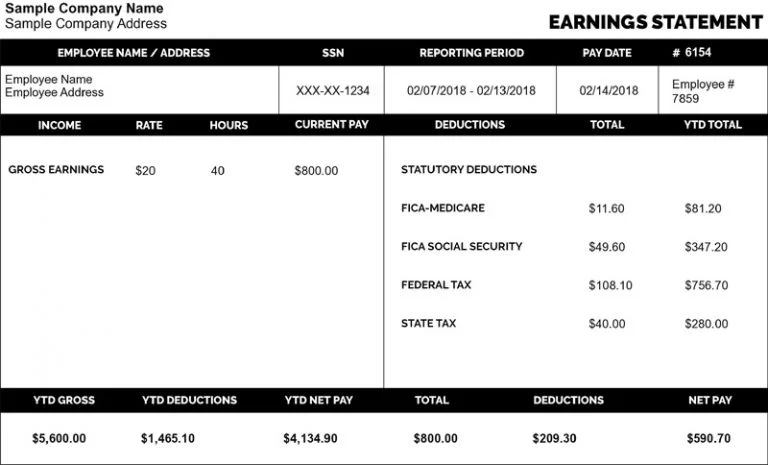

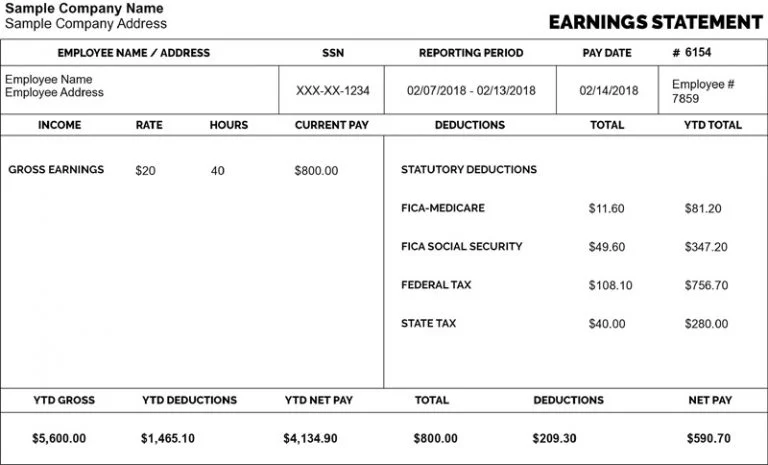

2026 Pay Stubs Deductions & Tax Withholding Explained

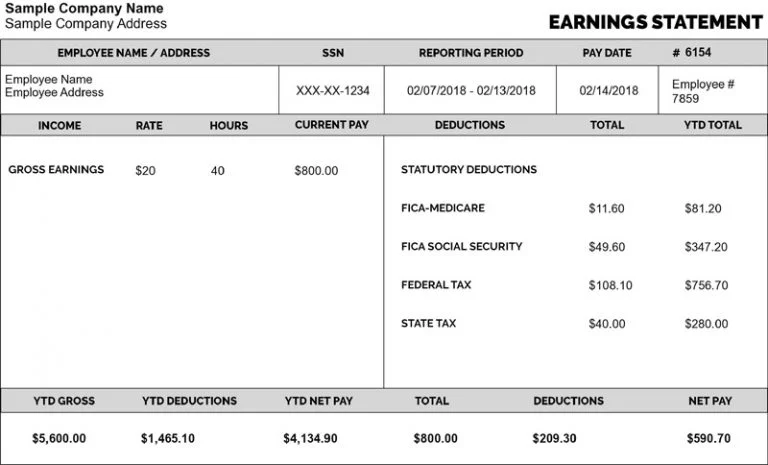

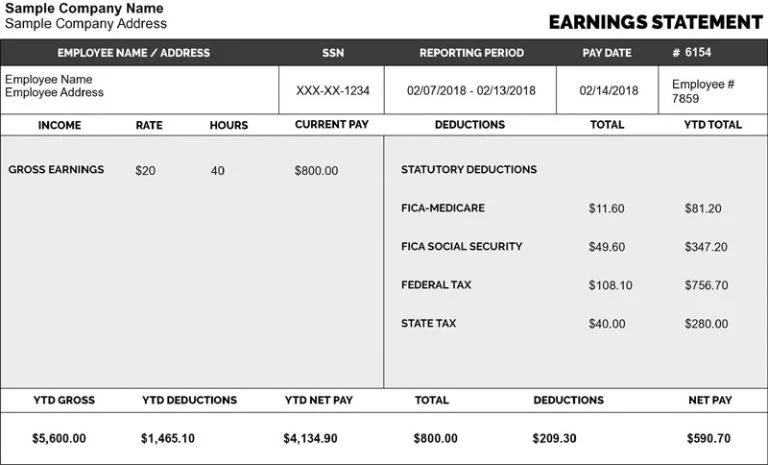

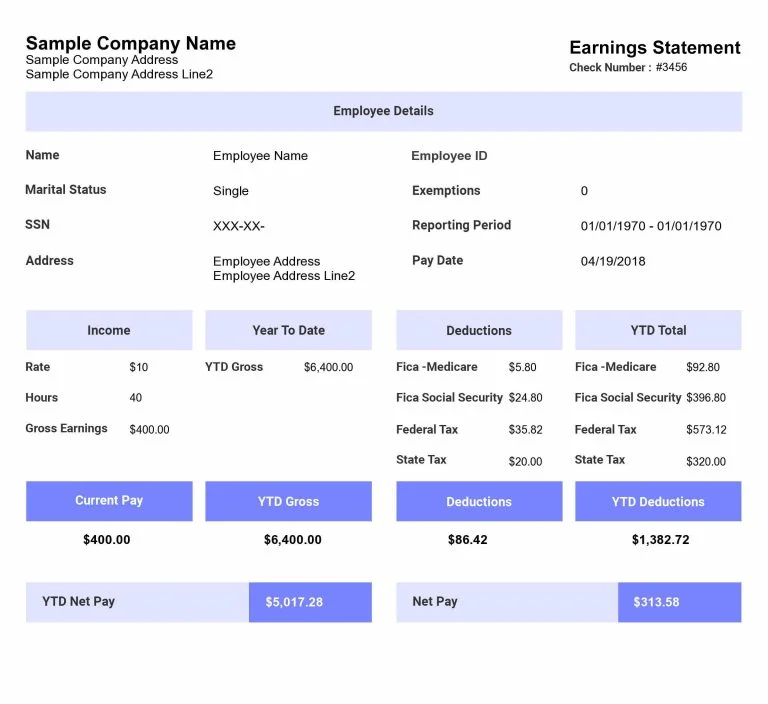

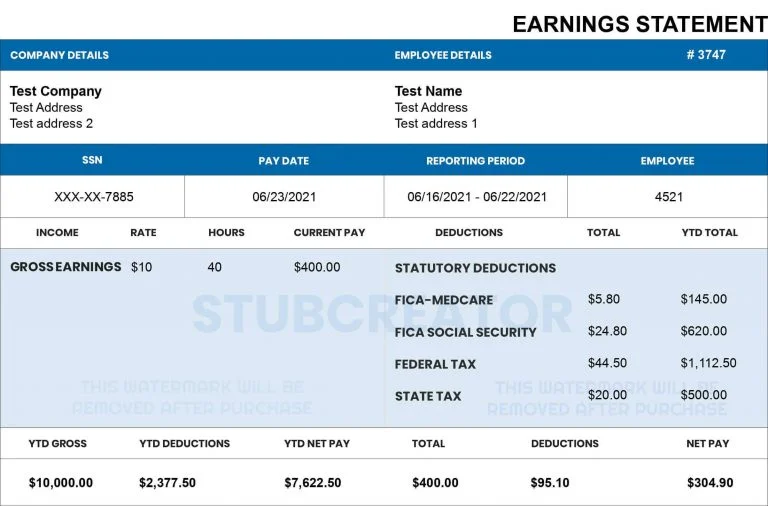

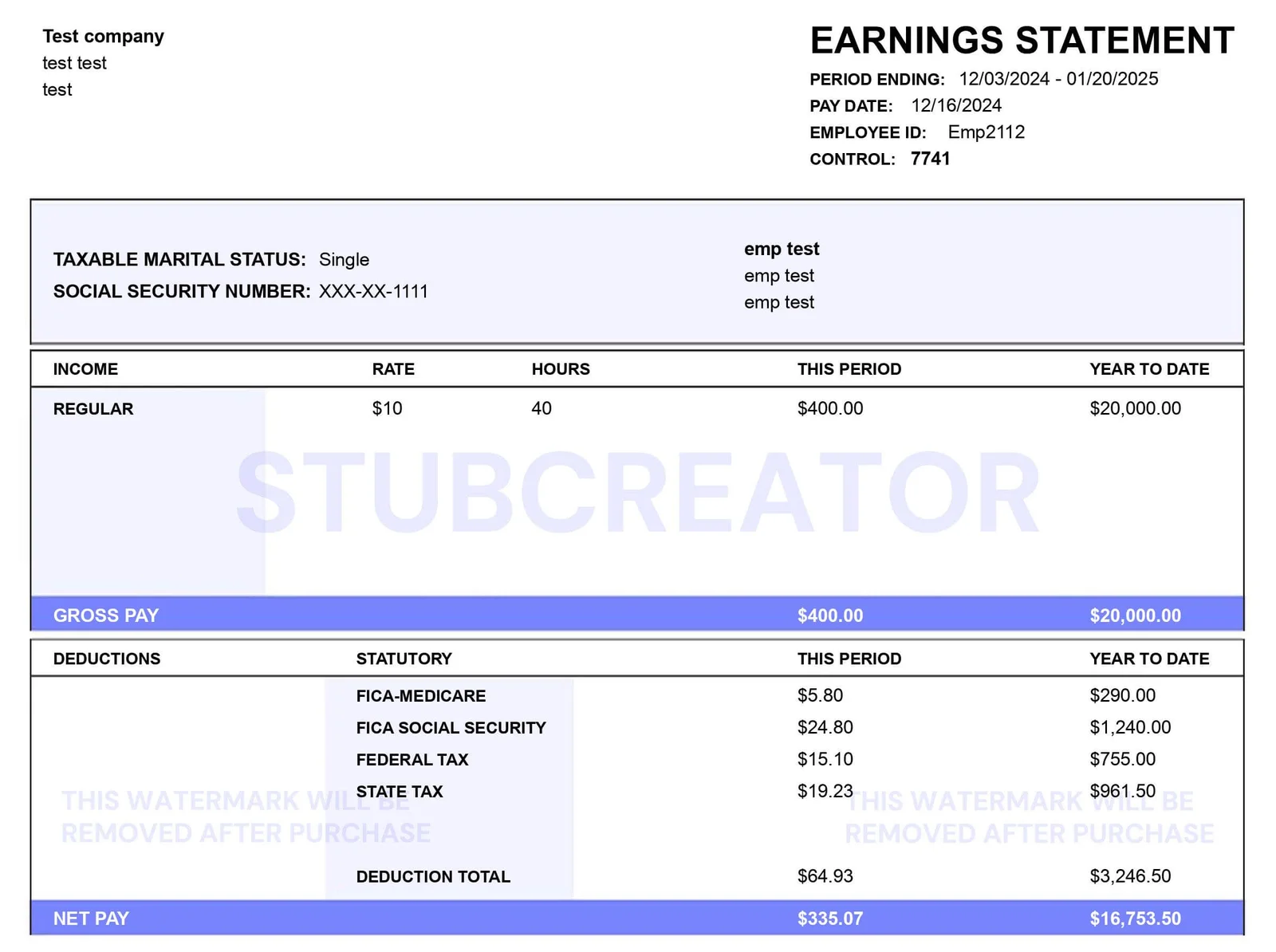

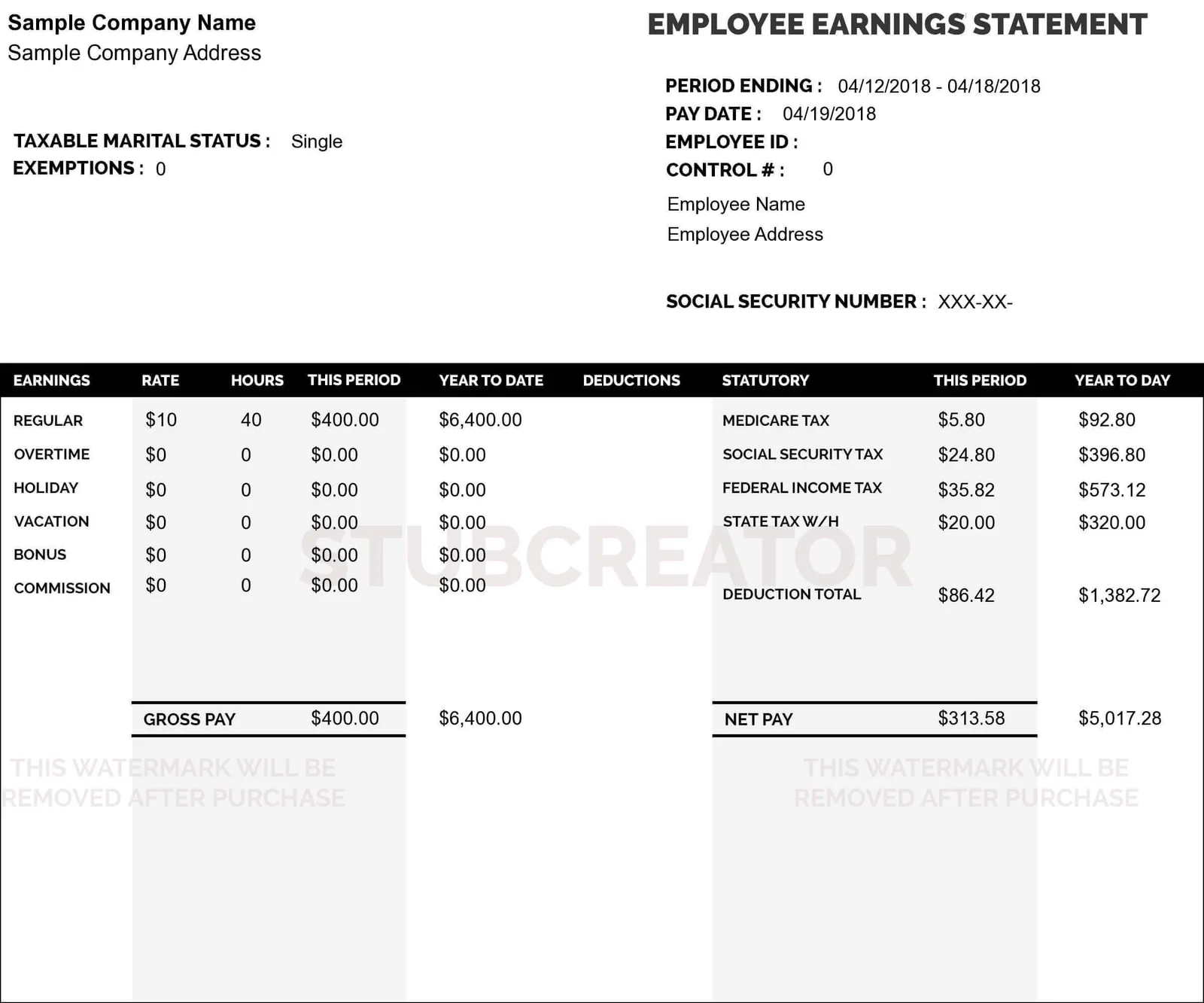

Payroll deductions are amounts taken from your employees’ paychecks before they receive the final amount as net pay. These payroll deductions apply to certain expenses such as taxes, benefit schemes, and savings initiatives like retirement contributions.

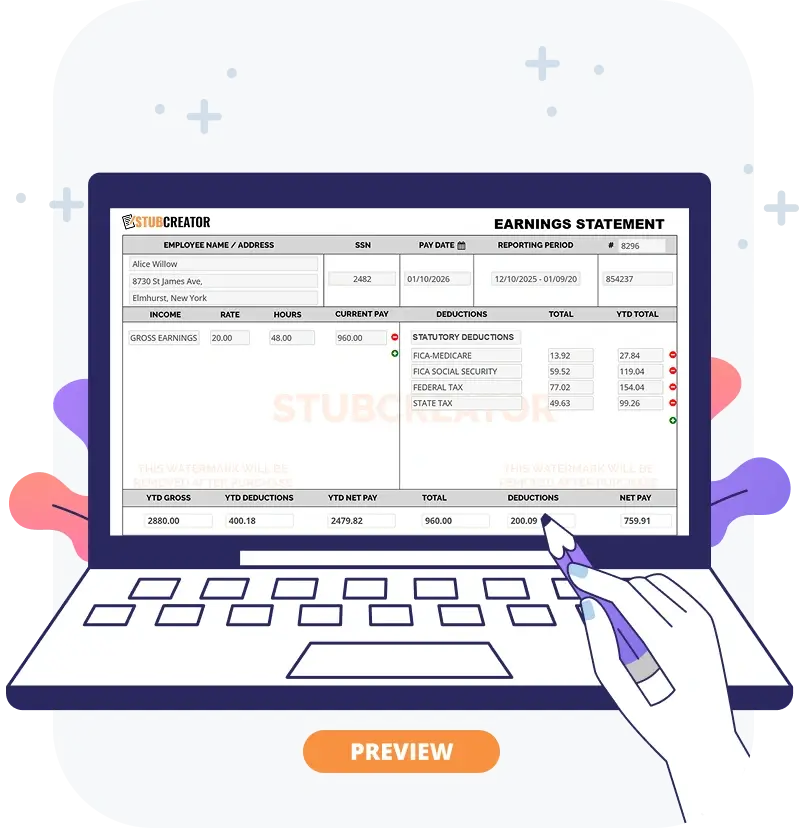

Employers have to make sure that the calculations and deductions of the taxes are accurate. To adjust tax calculations, you can use the Custom Paystub Generator. Common payroll deduction examples include: